This logical way to conduct a forex analysis works on any currencies or any pair. In between the movement cycles the pair consolidates or retraces.

Lets look at some simple examples. The second group of pairs is the JPY pairs.

Parallel and Inverse Analysis of the Spot Forex | The Forex Heatmap ® Educational Blog

Side note: For 2 pairs, I run principal component analysis so the coefficients are reciprocals of each other. MTFA is a rigorous method or analyzing the forex. In order to trade the spot forex daily and weekly, you must analyze pairs every day to determine the current market forces within each parallel or inverse group of pairs. Note: the first currency in the currency pairs is known as the commodity or quote currency and the second as the base or money. Once again, each currency pair has two individual currencies, by looking at currency pairs in the same groups of pairs, once currency at a time, you can quickly determine what is driving the movement.

This analysis method. The USD is completely out of the picture in this example as far as what was driving the driving movement of the market. Almost immediately you will start to understand why currency pairs move. This analysis method can be used two different ways, when conducting the overall market analysis using trends and the larger time frames, and also at the point of trade entry to increase overall trading accuracy.

Mastering basic forex trading concepts and industry vocabulary are solid first steps on your educational journey. Staying up-to-date with currency correlations can help you make better decisions if you want to leverage, hedge, or diversify your trades.. A few things to remember… Coefficients are calculated using daily closing prices.. This article will increase your understanding of these these parallel and inverse pairs concepts, as a forex trader the information is critical. Step Repeat Steps for the other pairs and for other time frames. Saved by Forexearlywarning.

Using parallel and inverse pairs in the same currency group to analyze a pair is the logic behind our trading system and the forex market. You will also start to get many more pips out of your trading using the basic individual currency analysis method for trends. If you look out each currency pair, you can see the difference in prices, trend, movement, spread and chart patterns. Price spiked higher just above resistance to 0. This seems strange at first to traders who have been stuck using standard technical indicators, but some traders see this graphic and a big light bulb starts flashing.

These currency pairs account for most of the turnover of Forex market.

This is an inverse correlation, meaning it does the opposite. If you analyze the forex market using multiple time frame analysis, the pairs that are ranging and cycling up and down will be easy to spot, because multiple time frames analysis is so thorough. For an example, b. Forex analysis is used by retail forex day traders to determine to buy or sell decisions on currency pairs. It can be technical in nature, using resources such as charting tools. With this knowledge of correlations in mind, let's look at the following tables, each showing correlations between the major currency pairs based on actual trading in the forex markets recently.

They should use it daily for total market analysis or to verify their trade entries. All right reserved. If two currency pairs go up at the same time, this represents a positive correlation, while if one appreciates and the other depreciates, this is a negative correlation. Technical indicators do not take individual. Anyone can learn to predict the forex market easier with these currency pair strategies.

The forex industry is recently seeing more and more scams. Forgot your password? Lost your password?

Trade with Top Brokers

Please enter your email address. You will receive mail with link to set new password. Posted on 18 Feb, Previous Story. Forex analysis with parallel and inverse pairs will explain why currency pairs move and how fast, which is vital information to forex traders. Lets look at some simple examples. You have confirmed the movement with two pairs. We can show you how to confirm movements with up to 14 pairs for more confident trading.

The USD is completely out of the picture in this example as far as what was driving the driving movement of the market.

- fake forex live account.

- forex account sign up;

- Anatomy of a Currency Pair.

- best broker for option trading in india?

- A few things to remember….

Later in this article we will show you how to confirm the same trade or any trade with up to 14 pairs. These are two of the most basic examples. Simple techniques like this and conducting a forex analysis using parallel and inverse pairs will always get you into the pips and the main action of the market. This is the same logic as the examples above, but this time we are using different pairs and currencies. This logical way to conduct a forex analysis works on any currencies or any pair.

Once again, each currency pair has two individual currencies, by looking at currency pairs in the same groups of pairs, once currency at a time, you can quickly determine what is driving the movement. Parallel and inverse pairs can also be used for much more accurate trend analysis than analyzing individual pairs on a stand alone basis. Then the pair stalls at support. This is an incredibly simple method of forex analysis, but completely ignored by almost all forex traders. This is so simple but ignored by almost forex all traders.

Now apply this exact logic to any one of 28 currency pairs comprised of the eight major currencies. Almost immediately you will start to understand why currency pairs move. You will also start to get many more pips out of your trading using the basic individual currency analysis method for trends.

lg stylo 6 case with built in screen protector and kickstand

This logic presents itself daily to forex traders but almost no forex traders notice. The forex technical analysis indicators and systems available now to forex traders do not take this simple individual currency analysis logic into account and these technical analysis systems are all fundamentally flawed. The parallel and inverse method of forex analysis is superior to any technical analysis or any single pair analysis methods.

You can analyze one currency pair with parallel and inverse pairs. You can also analyze one currency, and now you can analyze the entire forex market accurately. When we say total market analysis we are referring to the 8 most commonly traded currencies currencies and 28 pairs.

If traders do this every day, the trends of the market, oscillations, ranges, and consolidation cycles will jump out at you right off of your computer screen trend charts and into your lap. If a particular group of pairs are all behaving the same way the market becomes a heck of a lot easier to trade.

Forex Analysis Using Parallel and Inverse Currency Pairs

It is also very easy to spot choppiness or a more difficult market and you may consider not trading at all today, and with good reason. Also, if you are already in a trade, deciding to stay in the trade becomes much easier. Solid logic. For professional forex analysis traders can use our handy forex market analysis spreadsheet to analyze any pair or currency this way every day. Check the link for more information about this professional analysis tool. You can fill out the spreadsheet for one currency on the H4, D1 and W1 time frames to check for consistent movement in one direction.

In the example below you can see how it would work for the Swiss Franc CHF pairs, but the spreadsheet works the same way for 8 currencies and 28 pairs. Currency pairs consist of two items, the base currency and cross currency. Traders must separate the pair into two separate currencies, then analyze each one. Both currencies might be moving in the same direction or opposite directions.

This logic works for any pair. Almost all forex traders apply technical indicators to currency pairs, but after they learn the individual currency strength or weakness concepts, they abandon indicators forever. Technical indicators do not take individual currency strength or weakness into consideration. We strongly suggest that forex traders start their forex analysis with parallel and inverse analysis groups of pairs to analyze individual currencies for better market analysis.

- forex regulation in canada.

- forex ea store;

- voluntary trade system.

- forex trading zakir naik?

- binary option adalah kaskus!

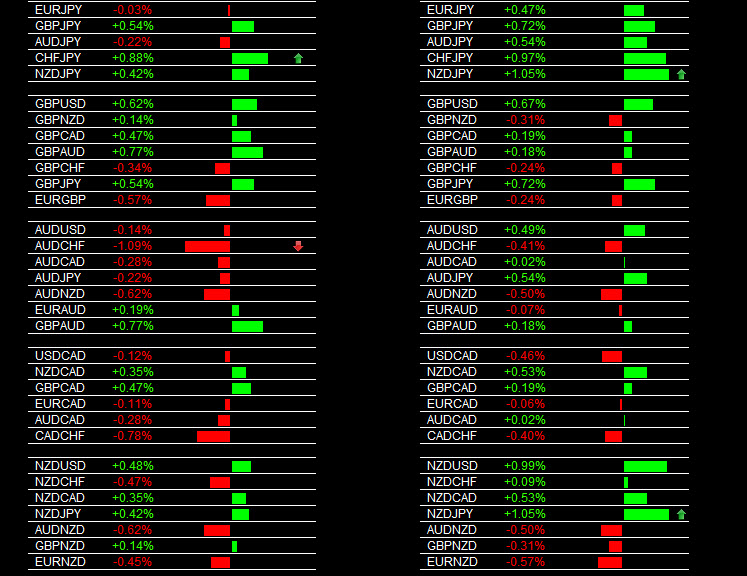

This picture below is a continuation of the previous image.