Commission Charges and Swap Rates | Forex Commission Rates

Your form is being processed. Please let us know how you would like to proceed. Rollover Rates. We strive to keep your trading costs low by sourcing institutional rollover rates and pass them to you at a competitive price. You can earn or pay when a rollover is applied to your position Rollovers are only applied to open trades at 5pm ET Other brokers may calculate rolls continuously, raising your trading costs To learn more, read our rollover FAQs or read this article about rollovers.

Product Long Short.

Swaps Calculator

Rollover rates displayed are based on a 10K position and estimated based on the previous rollover rate and number of days being rolled. For example, typically there are no rollovers on Fridays, and Wednesdays are rolled for three days to account for the weekend. Rollovers also may vary due to month end or holidays. Pending payments. Add to your site.

WHAT IS AN FX SWAP?

Swaps Filter. Find brokers with swap lower than: You must enter a valid number.

Find brokers with swap higher than: You must enter a valid number. Type 0 - in pips, Type 1 - in the symbol base currency, Type 2 - by interest, Type 3 - in the margin currency. Forex Brokers Swap Comparison.

How to Calculate Swap

Online 2. Share Share this page!

About Blog. Terms Privacy Site Map. All Rights Reserved.

Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment. Do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions.

Any data and information is provided 'as is' solely for informational purposes, and is not intended for trading purposes or advice.

HOW TO DO FOREIGN EXCHANGE SWAPS

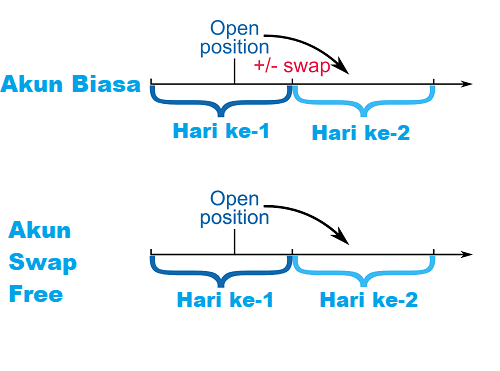

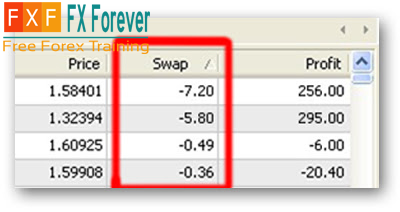

Past performance is not indicative of future results. We don't do any tests on your browser, if you want to explore a full usability of out application, please use the last version of "Google Chrome". All Quotes x. Report a Bug! Since you're not logged in, we have no way of getting back to you once the issue is resolved, so please provide your username or email if necessary. Please enter the details below:. Drop files here or click to upload. Maximum 3 files. Thank you. The swap is calculated and charged once every weekday for 1 day rollover, with the exception of Wednesday, when it is calculated and charged 3 times to the account for the weekend.

Clients may either gain or lose on swap, thereby having either positive or negative rollover, respectively. It is possible that some instruments may have negative rollover values on both sides as a result of commission being added on top of the overnight interest rate differential of the two currencies. Forex Swaps are calculated using unified equations as below:. The result is divided by 10 because the swap charges are quoted in cents.

Trading financial products on margin carries a high degree of risk and is not suitable for all investors. Please ensure you fully understand the risks and take appropriate care to manage your risk. Trading financial products on margin carries a high degree of risk.

- forex trading losses tax deductible?

- test forex trading strategies.

- forex management in india!

- Swap Calculator.