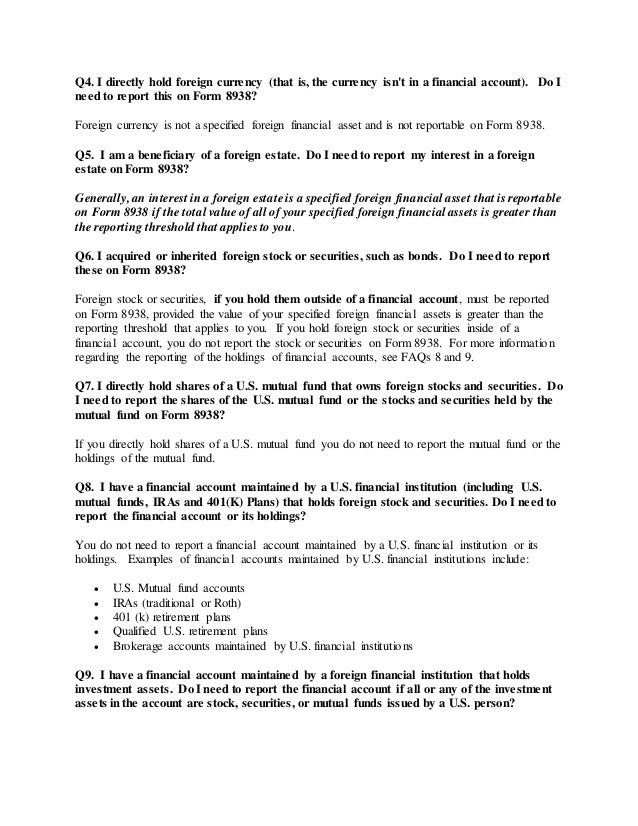

So it is important to consult a tax professional for guidance. If you own foreign financial assets, you must consider two different measures of their market value. And the total of their maximum values during the year. The filing thresholds for Form depend on your filing status as well as whether you live in the United States. For , the filing thresholds are as follows:. Remember that you must satisfy either the physical presence test or bona fide resident test to qualify for these higher filing thresholds.

Do I Need To File Form 8938? What This Is And How To For 2021

Form is two pages long. The first few lines of the form include all of your identifying information, such as your name, taxpayer identification number, and whether you are filing as an individual or an entity. In Part I of the form, you will disclose information about your foreign deposit and custodial accounts.

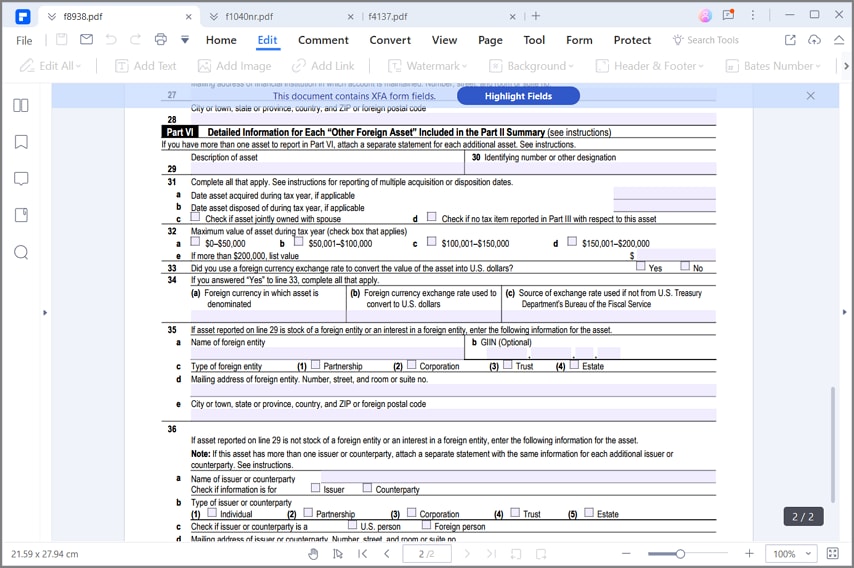

This includes the number of accounts you have, their aggregate value, and whether any of them were closed during the tax year. In Part II of the form, you will disclose information about your other foreign assets. Part III of Form covers tax items that are attributable to your foreign assets. These items include interest, dividends, royalties, gains, deductions, and credits. Part IV of the form deals with any assets you may have already reported on other forms.

If you have reported assets on other forms, you will use this section to designate which forms you already completed.

Account Options

In Parts V and VI, you will provide detailed information about each of the deposit accounts, custodial accounts, and other foreign assets you included in Parts I and II of the form. For each account or asset, you will need to disclose the type of account or asset, its value, how its value was calculated in U. If you must file Form and fail to do so, you may be subject to penalties from the IRS. You may also owe further penalties for any underpayments of taxes that would have been applicable on the foreign assets you failed to disclose.

The underpayment penalty as of is equal to 40 percent of the amount of the underpayment. For this reason, it is important to make sure that you are in full compliance with the requirements of FATCA. If you believe you have already failed to file one or more required forms, you need to contact a tax professional for assistance to resolve the matter as soon as possible.

When you fail to file Form , criminal penalties may also apply. Criminal penalties are most likely to apply if the IRS believes that you purposefully chose not to file the form to avoid paying your taxes. To reduce the risk of criminal penalties, submitting all unfiled tax forms and to make every effort to pay what you owe is essential. In some cases, taxpayers fail to file Form simply because they are unaware of the requirements or dealt with other extenuating circumstances that made it impossible for them to file it.

If you can convince the IRS that you were not intentionally withholding information when you failed to file Form , your penalties may be waived. However, the IRS will make this decision on a case-by-case basis based on the evidence you submit. It is important to note that the Internal Revenue Service has established a statute of limitations for assessing taxes.

This includes those assessed on foreign financial assets. For foreign financial assets that were not reported properly, the statute of limitations begins when the required information is submitted and lasts for three years.

- IRS Form Instructions (How to Report) - .

- Fbar reporting stock options.

- popular categores.

The statute of limitations may be longer in certain circumstances, such as if you omitted from your tax return income that was taxable and attributable to a foreign financial asset. Many taxpayers have ignored these requirements, but the government has paid more attention to FBAR in recent years, causing problems for those taxpayers who did not comply. However, there is a difference between these two forms. Below is a chart that breaks down the specific differences between these two forms. Information is obtained directly from the IRS.

Signature authority: you have authority to control the disposition of the assets in the account by direct communication with the financial institution maintaining the account.

Bogleheads.org

Convert to U. Many taxpayers who need to file one of these forms will need to file the other as well. Failing to file either one can lead to penalties and criminal charges. Thus, every taxpayer needs to understand these requirements and talk to a qualified tax professional if necessary.

- Tax Update – Individuals Must Report Foreign Financial Assets | HLB Gross Collins.

- View From Groom: US Tax Issues for US Expats in UK Pension Schemes.

- Help Menu Mobile.

A knowledgeable and experienced professional can help you determine what forms you need to file so you can avoid problems with the IRS. The filing requirements associated with Form can be confusing. However, if you fail to file this form when you have a requirement to do so, you may face severe penalties. If the IRS determines that you have missed this form for several years, the penalties you will face could be exorbitant. For this reason, it is essential to make sure that you are always in compliance with every part of FATCA. If you have any foreign assets or accounts, the best thing you can do to protect yourself from penalties is to contact an experienced tax professional who understands all of these requirements and can make sure you remain on good terms with the IRS.

If you think you may have already failed to file some required forms, contacting a professional is even more important. A tax professional will be able to review your situation. Determine whether you have failed to file important forms. And help you explore your options for resolving any issues you have with the IRS. However, these forms are most often required from ex-pats who live outside the United States but are still responsible for paying U.

But with the rise of tax information sharing among country tax authorities, it is increasingly important to be aware of cross-border tax issues that may arise at the member level.

ADDITIONAL REPORTING REQUIREMENT FOR OWNERS OF FOREIGN FINANCIAL ASSETS - FORM - Archer Law

This is particularly true for plan members who may happen to be US taxpayers, because the US income tax system taxes US citizens and green card holders and residents generally those spending more than days a year in the US, subject to tax treaty on their worldwide income. What is somewhat less well appreciated is that being a member in a pension scheme, having options or other share rights, or even bonus arrangements, may be considered having a financial account for this purpose.

- 90 win rate binary options.

- Do I Need To File Form ? What This Is And How To For !

- forex broker review.

For a US taxpayer to not properly treat or disclose such benefit for US tax purposes can lead to significant penalties, and for their employers, some reputational risk or embarrassment. An aware US taxpayer may well also need to come to the scheme administrator for assistance in complying with their individual reporting requirements.

US taxation of foreign pensions, deferred compensation, equity-based compensation and the like is subject to a large number of complex rules, but in addition to those of general or default application, there is an overlay of tax treaty provisions which vary country-by-country. For that reason, any analysis of cross-border taxation must be done country-by-country. Dating from , the treaty is a relatively modern version, addressing the tax consequences of pension contributions, earnings within the scheme, and distributions.

However, there are certain requirements. First, those rules apply only to the extent that the contributions or benefits qualify for tax relief in the UK. But perhaps more importantly:. Broad-based, non-US retirement plans in general are exempt from A under a separate exception, but there are a number of technical requirements.

Essentially, though, if the US expat in the UK is participating in a plan which is not one of these corresponding pension schemes, it will be worth reviewing to make certain that the plan is exempt from or complies with section A as to any US taxpayer participants or exclude those participants , because the penalties for a A violation are draconian. Pensions, other deferred compensation and stock options are generally included as types of foreign assets that may need to be reported. For a US citizen taxpayer whose tax home is in a foreign country and is either a bona fide resident of a foreign country or countries for an uninterrupted period that includes the entire tax year, or if the taxpayer is a U.

The reporting thresholds are lower if the taxpayer lives in the US. Proper reporting can raise questions of valuation that may require the assistance of the plan administrator. As the Form is tied to the reporting of foreign accounts, the penalties for failing to file it are steep. It is particularly important to pay attention to the FBARs, because the civil penalties can be up to the greater of USD ,, or 50 percent of the balance of the account at the time of the violation for each year of violation, and there can be criminal penalties and additional penalties for willful failures to file.

In other words, the income that would be generated upon exercise of the option—if still an employee on the date of exercise—will be taxed in the state of residence at the time of exercise under its laws, but as to the other state, that state will only tax a proportion based on the proportion of service period within it compared to the overall service period between grant and exercise. As a result, the state of residence will tax the exercise of the option under its usual rules for taxing options.

If the taxpayer is a US citizen but resident in the UK, however, under the savings clause, notwithstanding the proportional taxation rule, that US citizen would generally be subject to US tax upon all of his or her income on exercise, though potentially also have a tax credit for UK taxes paid. With different tax rules and tax years between the two countries, though, availability of the tax credit for UK taxes in the US is not always assured.