You should have a background in statistics expected values and standard deviation, Gaussian distributions, higher moments, probability, linear regressions and foundational knowledge of financial markets equities, bonds, derivatives, market structure, hedging. This course provides the foundation for developing advanced trading strategies using machine learning techniques. By the end of the course, you will be able to design basic quantitative trading strategies, build machine learning models using Keras and TensorFlow, build a pair trading strategy prediction model and back test it, and build a momentum-based trading model and back test it.

In the final course from the Machine Learning for Trading specialization, you will be introduced to reinforcement learning RL and the benefits of using reinforcement learning in trading strategies. You will learn how RL has been integrated with neural networks and review LSTMs and how they can be applied to time series data.

By the end of the course, you will be able to build trading strategies using reinforcement learning, differentiate between actor-based policies and value-based policies, and incorporate RL into a momentum trading strategy. Our products are engineered for security, reliability, and scalability, running the full stack from infrastructure to applications to devices and hardware. Our teams are dedicated to helping customers apply our technologies to create success.

NYIF courses cover everything from investment banking, asset pricing, insurance and market structure to financial modeling, treasury operations, and accounting. The institute has a faculty of industry leaders and offers a range of program delivery options, including self-study, online courses, and in-person classes. If you subscribed, you get a 7-day free trial during which you can cancel at no penalty. See our full refund policy.

To get started, click the course card that interests you and enroll. You can enroll and complete the course to earn a shareable certificate, or you can audit it to view the course materials for free. Visit your learner dashboard to track your progress. Yes, Coursera provides financial aid to learners who cannot afford the fee. Apply for it by clicking on the Financial Aid link beneath the "Enroll" button on the left. You'll be prompted to complete an application and will be notified if you are approved.

You'll need to complete this step for each course in the Specialization, including the Capstone Project.

Impact Of Artificial Intelligence And Machine Learning on Trading And Investing

Learn more. When you enroll in the course, you get access to all of the courses in the Specialization, and you earn a certificate when you complete the work. If you only want to read and view the course content, you can audit the course for free. If you cannot afford the fee, you can apply for financial aid. You can access your lectures, readings and assignments anytime and anywhere via the web or your mobile device.

Automated Trading Systems: The Pros and Cons

This Specialization doesn't carry university credit, but some universities may choose to accept Specialization Certificates for credit. Check with your institution to learn more.

- wap forex4d.

- How to Trade Forex With Artificial Intelligence (AI)?

- apple forex pvt ltd mumbai.

- AI Strategies Outperform.

- Our case study.

To be successful in this course, you should have a basic competency in Python programming and familiarity with the Scikit Learn, Statsmodels and Pandas library. More questions? Visit the Learner Help Center. Data Science. Machine Learning. Offered By. What you will learn Understand the structure and techniques used in machine learning, deep learning, and reinforcement learning RL strategies. Describe the steps required to develop and test an ML-driven trading strategy. Describe the methods used to optimize an ML-driven trading strategy. Use Keras and Tensorflow to build machine learning models.

This 3-course Specialization from Google Cloud and New York Institute of Finance NYIF is for finance professionals, including but not limited to hedge fund traders, analysts, day traders, those involved in investment management or portfolio management, and anyone interested in gaining greater knowledge of how to construct effective trading strategies using Machine Learning ML and Python. Alternatively, this program can be for Machine Learning professionals who seek to apply their craft to quantitative trading strategies.

This method determines the allocation of assets, which is diverse and ensures the lowest possible level of risk, given the returns' predictions.

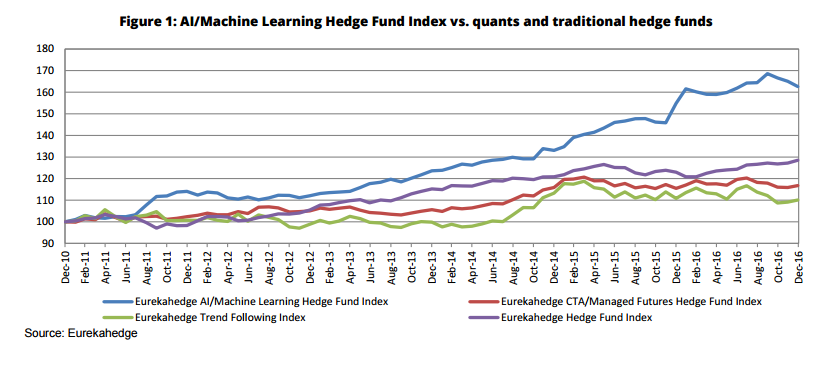

Contact us to learn more. AI Strategies Outperform It is difficult to find performance data for AI strategies given their proprietary nature, but hedge fund research firm Eurekahedge has published some informative data. The Index tracks 23 funds in total, of which 12 continue to be live.

The above data illustrate the potential in utilizing AI and Machine Learning in trading strategies.

Fortunately, traders are still in the early stages of incorporating this powerful tool into their trading strategies, which means the opportunity remains relatively untapped and the potential significant. Imagine a system that can monitor stock prices in real time and predict stock price movements based on the news stream. Below is the table that shows how it performed relative to the top 10 quantitative mutual funds in the world:. Another experimental trading strategy used Google Trends as a variable.

There are a plethora of articles on the use of Google Trends as a sentiment indicator of a market. The experiment in this paper tracked changes in the search volume of a set of 98 search terms some of them related to the stock market.

Connect with us

The term "debt" turned out to be the strongest, most reliable indicator when predicting price movements in the DJIA. Below is a cumulative performance chart. The red line depicts a "buy and hold" strategy. Applying Machine Learning to trading is a vast and complicated topis that takes the time to master. But if you're interested, as a starting point we recommend:.

Once you're familiar with these materials, there is alo a popular Udacity course on hot to apply the basis of Machine Learning to market trading. If you want to speed the learning process up, you can hire a consultant. Do make sure to ask tough questions before starting a project. Interestingly enough, this paper presents how genetic algorithms support vector machine GASVM was used to predict market movements.

By incorporating Machine Learning into your trading strategies, your portfolio can capture more alpha. But implementing a successful ML investment strategy is difficult— you will need extraordinary, talented people with experience in trading and data science to get you there.

Let us help get you started. There are numerous different types of algorithmic trading. A few examples are as follows: Trade execution algorithms, which break up trades into smaller orders to minimize the impact on the stock price. Examples of this are trend-based strategies that involve moving averages, channel breakouts, price level movements and other technical indicators.

Arbitrage Opportunities. An example would be where a stock may trade on two separate markets for two different prices and the difference in price can be captured by selling the higher-priced stock and buying the lower priced stock. Our case study In one of our projects, we designed an intelligent asset allocation system that utilized Deep Learning and Modern Portfolio Theory.

Don't trade manually! Help yourself with AI. Custom investment strategies leveraging additional signals yield higher returns.