Binary options are often considered a form of gambling rather than investment because of their negative cumulative payout the brokers have an edge over the investor and because they are advertised as requiring little or no knowledge of the markets. Gordon Pape , writing in Forbes. Pape observed that binary options are poor from a gambling standpoint as well because of the excessive "house edge".

Let's say you make 1, "trades" and win of them. In other words, you must win The U. Commodity Futures Trading Commission warns that "some binary options Internet-based trading platforms may overstate the average return on investment by advertising a higher average return on investment than a customer should expect given the payout structure. In the Black—Scholes model , the price of the option can be found by the formulas below.

This pays out one unit of cash if the spot is above the strike at maturity. Its value now is given by. This pays out one unit of cash if the spot is below the strike at maturity. This pays out one unit of asset if the spot is above the strike at maturity. This pays out one unit of asset if the spot is below the strike at maturity. The price of a cash-or-nothing American binary put resp. The above follows immediately from expressions for the Laplace transform of the distribution of the conditional first passage time of Brownian motion to a particular level.

Similarly, paying out 1 unit of the foreign currency if the spot at maturity is above or below the strike is exactly like an asset-or nothing call and put respectively. The Black—Scholes model relies on symmetry of distribution and ignores the skewness of the distribution of the asset. The skew matters because it affects the binary considerably more than the regular options. A binary call option is, at long expirations, similar to a tight call spread using two vanilla options.

Thus, the value of a binary call is the negative of the derivative of the price of a vanilla call with respect to strike price:. Skew is typically negative, so the value of a binary call is higher when taking skew into account. Since a binary call is a mathematical derivative of a vanilla call with respect to strike, the price of a binary call has the same shape as the delta of a vanilla call, and the delta of a binary call has the same shape as the gamma of a vanilla call. Many binary option "brokers" have been exposed as fraudulent operations.

Manipulation of price data to cause customers to lose is common. Withdrawals are regularly stalled or refused by such operations; if a client has good reason to expect a payment, the operator will simply stop taking their phone calls.

On 23 March , The European Securities and Markets Authority , a European Union financial regulatory institution and European Supervisory Authority located in Paris, agreed to new temporary rules prohibiting the marketing, distribution or sale of binary options to retail clients. In August , Belgium's Financial Services and Markets Authority banned binary options schemes, based on concerns about widespread fraud. No firms are registered in Canada to offer or sell binary options, so no binary options trading is currently allowed.

Provincial regulators have proposed a complete ban on all binary options trading include a ban on online advertising for binary options trading sites.

What are Binary Options and How Do They Work? | Nadex

The effect is that binary options platforms operating in Cyprus, where many of the platforms are now based, would have to be CySEC regulated within six months of the date of the announcement. In , CySEC prevailed over the disreputable binary options brokers and communicated intensively with traders in order to prevent the risks of using unregulated financial services.

CySEC also temporarily suspended the license of the Cedar Finance on December 19, , because the potential violations referenced appeared to seriously endanger the interests of the company's customers and the proper functioning of capital markets, as described in the official issued press release. CySEC also issued a warning against binary option broker PlanetOption at the end of the year and another warning against binary option broker LBinary on January 10, , pointing out that it was not regulated by the Commission and the Commission had not received any notification by any of its counterparts in other European countries to the effect of this firm being a regulated provider.

OptionBravo and ChargeXP were also financially penalized. The AMF stated that it would ban the advertising of certain highly speculative and risky financial contracts to private individuals by electronic means. The French regulator is determined to cooperate with the legal authorities to have illegal websites blocked. This ban was seen by industry watchers as having an impact on sponsored sports such as European football clubs. In March binary options trading within Israel was banned by the Israel Securities Authority , on the grounds that such trading is essentially gambling and not a form of investment management.

A Guide to Trading Binary Options in the U.S.

The ban was extended to overseas clients as well in October In The Times of Israel ran several articles on binary options fraud. The companies were also banned permanently from operating in the United States or selling to U. The CEO and six other employees were charged with fraud, providing unlicensed investment advice, and obstruction of justice.

On May 15, , Eliran Saada, the owner of Express Target Marketing , which has operated the binary options companies InsideOption and SecuredOptions, was arrested on suspicion of fraud, false accounting, forgery, extortion , and blackmail. In August Israeli police superintendent Rafi Biton said that the binary trading industry had "turned into a monster". He told the Israeli Knesset that criminal investigations had begun. They arrested her for wire fraud and conspiracy to commit wire fraud. Smith was arrested for wire fraud due to his involvement as an employee of Binarybook.

This required providers to obtain a category 3 Investment Services license and conform to MiFID's minimum capital requirements ; firms could previously operate from the jurisdiction with a valid Lottery and Gaming Authority license. In April , New Zealand 's Financial Markets Authority FMA announced that all brokers that offer short-term investment instruments that settle within three days are required to obtain a license from the agency.

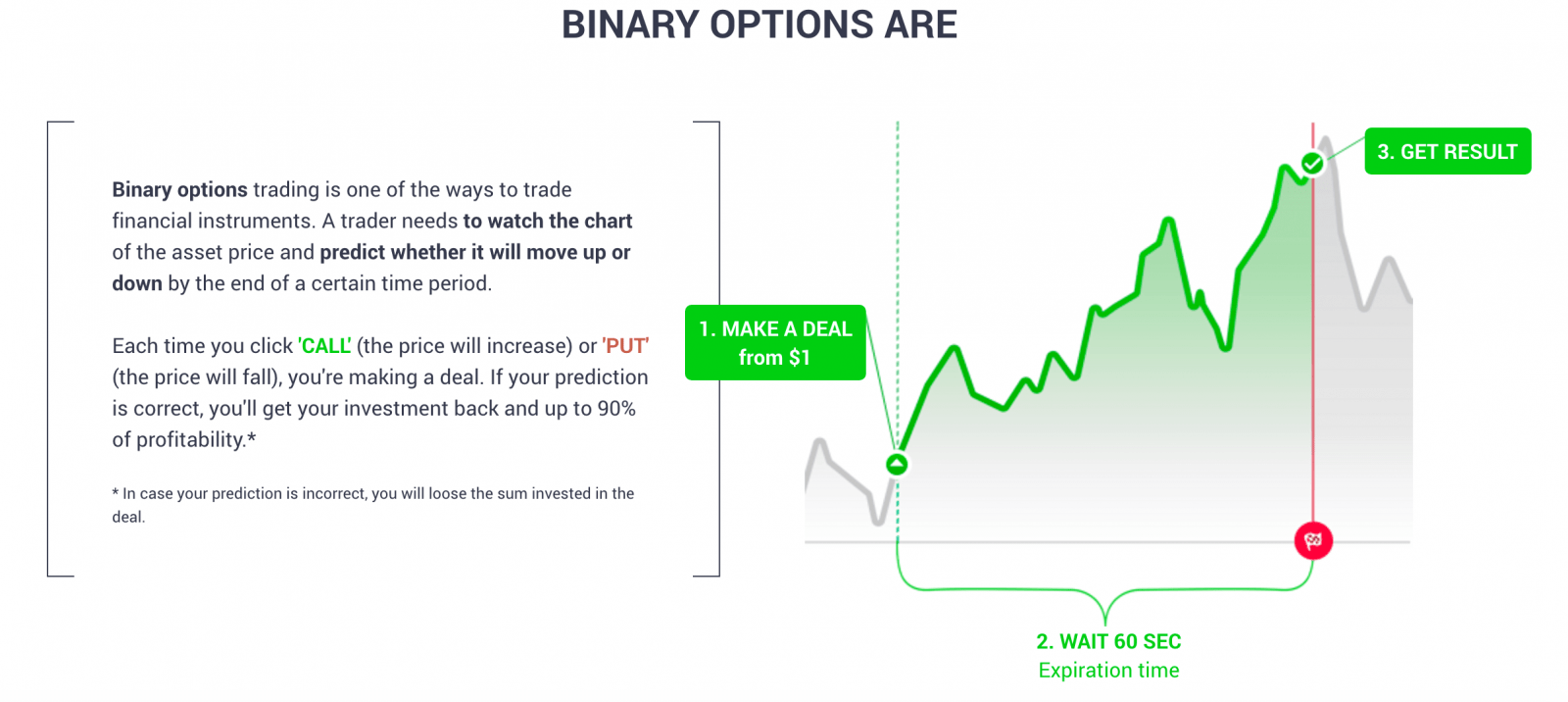

1. What’s binary options trading and how does it work?

The Isle of Man , a self-governing Crown dependency for which the UK is responsible, has issued licenses to companies offering binary options as "games of skill" licensed and regulated under fixed odds betting by the Isle of Man Gambling Supervision Commission GSC. On October 19, , London police raided 20 binary options firms in London. Fraud within the market is rife, with many binary options providers using the names of famous and respectable people without their knowledge.

In the United States, the Securities and Exchange Commission approved exchange-traded binary options in Just like the U. S trades, there is an expiration time. Brokers outside of the U. S cannot solicit US citizens unless they register with the regulatory bodies in the U. Otherwise you lose the whole stake. This is all quite similar to the U. S example. However outside of the U.

S, the minimum and maximum investments will vary greatly depending on the broker you choose. In some cases, the price at expiration might be the last quoted price. Again, the difference here is that outside the US, the broker will outline its own expiration price rules.

If the price expires on the strike price, it is not uncommon for the trader to be returned their original investment, although different brokers apply different rules. The original investment or profit is added to the traders account automatically when the position closes. With international brokers, you will typically be offered more option types, too. This means the traded instrument must touch the strike price once only to earn a profit. With this, traders select a price range that the asset will trade within until the expiration.

If the price stays within the range traders will receive a payout. If it goes outside the range the original investment will be lost. Although the requirements and product structures may change, the risk and reward is always set out from the beginning, enabling traders to potentially earn more than they could lose. Unlike trading in the U. S, some not all international brokers allow traders to leave positions before the expiration. When you exit a trade before expiration you usually will receive a lower payout or only a small loss without losing your whole investment. As you might have gathered by now, unlike the stock or forex markets where slippage and price gaps can happen, the risk and reward are known from the outset which is a major advantage.

Another big advantage for beginners, the structure is simple and you just make one call: will the underlying asset increase or decrease in price? Binary options are accessible and traders can access numerous asset classes at any stage while the market is open.

Even better, more products are being added so that brokers can stay competitive. The other side of binary options trading is that as the reward is always lower than the risk, and traders will need to be right a high percentage of the time to make up for and profit from the inevitable losses.

With that, the gain is always capped. Buying multiple contracts can help you reach a higher profit point from a predicted price move. While the payout and risk does fluctuate from broker to broker and instrument to instrument, one fact remains true: when you lose, you will lose more than you could make when you win. Apart from the typical binary options, you might give payouts where the reward might be bigger than the risk but it will be more difficult to win.