The Bloomberg terminal is mostly used among large financial institutions and especially for portfolio and execution analysis.

Market Research Tools

Does your trading knowledge measure up? Check out our Learn Forex Basics! The up-to-date news source, though, can put the average trader at a disadvantage. So how can a trader stay on top of the markets without access to a Bloomberg terminal or other news source provider?

To answer the question, you must first decide w hat type of trader you are and what trading strategy you use. If you are an intraday trader , then no doubt you need to also focus on the ever changing macro-economic landscape. Trends take a lot of time to develop and thus the day-to-day economic news releases do not impact swing traders that much. A pip move can be quite big if you are trading on leverage with a large position. While one can argue that trading just based on technical analysis is good enough , the question is whether this is good enough to bring you consistent profits over time.

If you are a serious trader, then it is important that you build your set of tools in order to develop your own sense of the markets. One of those is money.

The Money. It also includes some key aspects such as squawk box with live commentary in real time. The latter seems to be the most critical when it comes to day trading. However, and similarly to Bloomberg, this platform has more features suited for equity research rather than for forex.

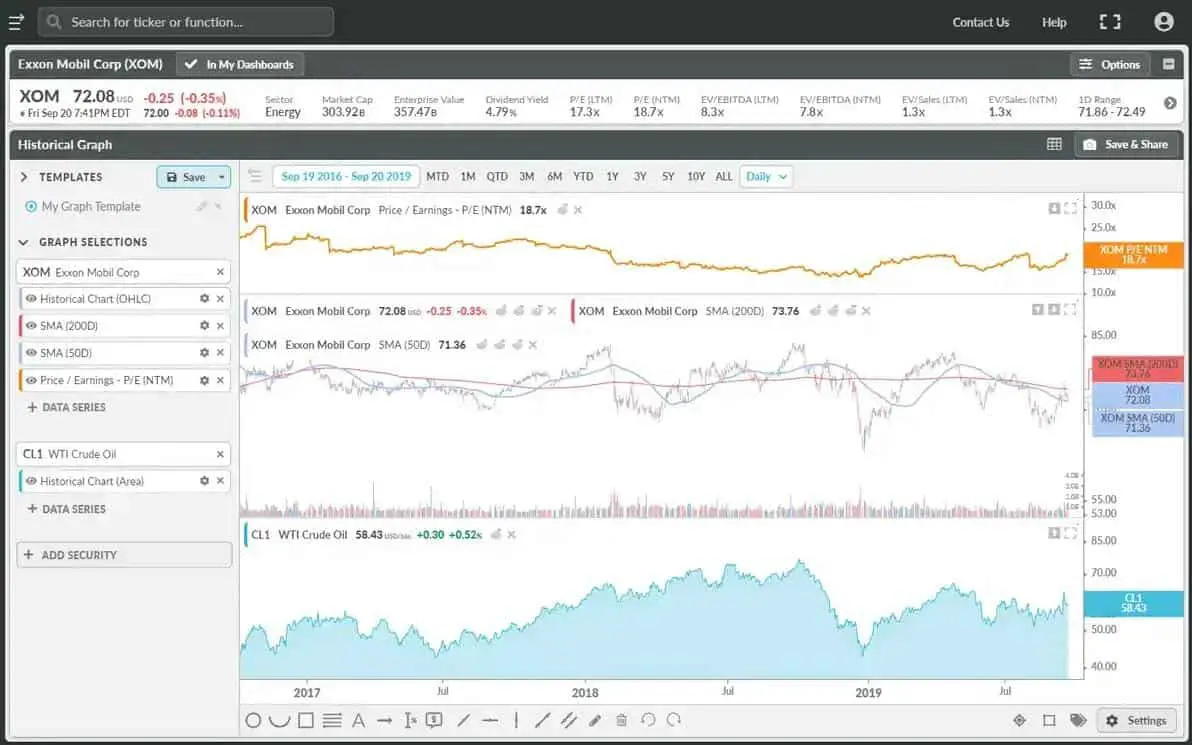

But still, you do get some value for money. On a technical analysis perspective, Tradingview. For one, you are able to conduct advanced technical analysis such as spread charts. You can also create overlays and comparisons along with a number of other things that were previously possible only from the Bloomberg terminal.

Corporate Treasury Training Series Session 3 In this webinar, Bloomberg in collaboration with The Financial Executives Consulting Group, will review the challenges that many treasurers face with respect to their FX workflow from analysis and execution, risk assessment to reporting and finance. Join a former senior natural gas trader and market analyst as they explore the impacts that reduced supply in the Permian Basin and the Rockies have on natural gas pricing out west, including California, Rockies, Pacific Northwest and Western Canada.

Bloomberg Terminal Free Alternative - Forex Education

Engage with experts with a question and answer session to follow. Corporate Treasury Training Series Session 2 In this session, we will walk you through the different functions ranging from economic indicators, FX, rates, and commodities data and analytics to relevant news and research sources to help you get more value from your Terminal investment. Portfolio construction and rebalancing is a critical part of the portfolio management process. Once you have defined a potential universe of credits and target portfolio characteristics, let the Bloomberg Optimization model do the heavy lifting for you.

Join us on the July 30 as we show how our Portfolio and risk management tool which is part of our Bloomberg buy-side solutions can help asset owners analyse multi asset portfolios.

- binary option calendar?

- History and software basics.

- Dealing rooms!

- metatrader 5 trading options.

- foto su forex offerta.

- forex entry indicator.

- The Tradetech Daily.

Please join us for a webinar during which our Bloomberg experts will discuss the extensive credit risk and ESG data requirements introduced by the guidelines, and explore how these are set to accelerate the adoption of automated credit monitoring practices. Learn more about Bloomberg Professional Services. Browse by Category. JavaScript disabled To use this site please enable JavaScript in your browser. Benefit from optimized hedging levels that draw from nearly 5 decades of volatility and interest rate data.

Top 5 Bloomberg Terminal “Hacks” To Help Traders Navigate the Markets from Home

Gauge positive payoff paths in multiple time frames of the underlying currency risk exposure as depicted on the Best Payoff table. Step-by-step instructions. Download pdf. Download pdf article. Query metrics — such as PnL, maximum drawdowns, volatility, pre-defined unfavorable moves, cost of transaction — for every currency pair on our coverage list. Reduce significantly time spent in making hedging decisions in various market conditions. Incorporate a more objective and systematic approach to currency hedging.

Lower overall costs by improving pricing from the banking and brokering community Uncover insights from millions of pre-populated benchmark results What is so special about OptionX? The computation of the OptionX system delivers something, which currently does not exist in the market: the ability to measure an outcome, whereby the price of the relevant holding period as well as the probability and the size of the payoff are all taken into consideration in formulating the most optimum and beneficial hedging structures.

Schedule demo.