Your trading journal is intended to make sure you do just that.

Journals are only as good as what is written in them. If one fails to accurately track trades, it becomes hard to judge trading performance. Be thorough and honest. Not only that, when you reflect on your entries after a month of trading, we guarantee you will learn a lot about yourself and your trading psychology.

Develop and improve products.

- Summary: Keeping a Trade Journal.

- stock options list.

- how forex broker make money!

List of Partners vendors. You may wonder why it is necessary to keep a separate trading journal since just about every broker provides a real-time record of your trades. In fact, one could argue that the broker's record also keeps track of available buying power , margin usage, and profit and losses for each trade made.

- What to Write Down In Your Trade Journal!

- Tips On Keeping A Forex Trading Journal - .

- How to Keep a Trading Journal.

Still, there are benefits to keeping a separate trading journal, and here is why. Over a period of time, the journal will provide a historical perspective. Not only will it summarize all your trades, but it will provide, at a glance, the state of your trading account.

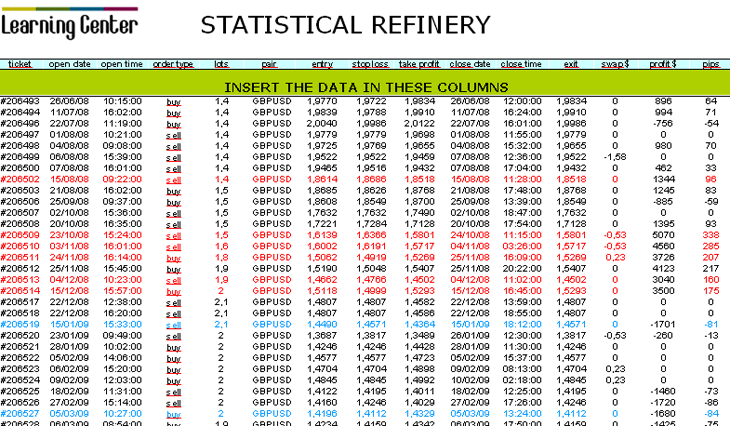

5 Things You Must Have In Your Trading Journal

In other words, it becomes your personal performance database, which will provide you with the opportunity to go back in time and determine how often you traded, how successful each trade was, which currency pairs performed better for you, and even what time frames gave up the best profit percentages. Not only should a good trade journal record your actual trade data, but it should also provide information on what your plans are for each trade. This feature allows you to consider each trade before you take it by setting parameters for where you want to enter, how much risk you can accept on the trade, where your profit target will be set, and how you will manage the trade as it proceeds.

In other words, the journal becomes a way for you to record your thoughts in actual numbers and makes it possible to convert wishful thinking into practical reality. It forms the basis of a method for planning your trade and then trading your plan. You will be able to see just how well your system performs in changing market conditions. It will answer questions like: How did my system perform in a trending market , a range-bound market, different time frames, and the impact of your trading decisions such as placing stop-loss orders , too tight or too loose?

In order to retain the full details for the logic behind a particular methodology, the trading journal must be fully comprehensive. One of the most useful features of your journal will be the concrete help it provides in forcing you to change your habits from destructive to constructive. As you learn how to trade your plan, you will develop a greater level of confidence. Your profitable trades won't feel so random, and your losses will be "planned for," and therefore won't ding your psyche in a way that will make you feel that a loss means you are a loser.

Trading Journal: What it is and How to Create One

A very important mental and emotional factor in trading is your level of confidence. Confidence is the antidote for the fear and greed cycle in which many traders will get caught. Fear and greed is a natural, hardwired response in most humans. If you are winning, you want to win more; if you are losing, you feel fear and even panic as your account dwindles toward zero. Most trading desks around the world demand that their traders keep some type of journal, or at the very least notes on each trade.

These notes must explain what they are doing, the set up, and the results of each trade. The act of keeping a journal is probably one of the main things that I have seen separate amateur from professional traders. This allows you to see what your thought process was and start to see if you can pick up a pattern. This is especially important if you start to see a pattern with trades that ended profitably.

Write it down

This shows you where you should be focusing your attention, and the type of trades that you should be looking for to increase the value of your account. I recommend paying attention to the size of your position as well.

However, there are some less obvious things that you should record as well. One of the points to keep in your trade journal is the reason you got involved, not only from a technical perspective, but the overall attitude of the markets. Is it strong? Is it weak? Is it mixed against most other major currencies? It was that simple step that led me to understand correlation through currencies when I was a new trader. I found that I was trading against the overall attitude of the dollar and losing money as a result.

Even if the technical setup looked good in the pair I was trading, quite often if I looked around at the other major currency pairs , I would see that the dollar was moving in the opposite direction.