The trader's forex account is established to allow trading on margin or borrowed funds. Some brokers may limit the amount of leverage used initially with new traders. In most cases, traders can tailor the amount or size of the trade based on the leverage that they desire. However, the broker will require a percentage of the trade's notional amount to be held in the account as cash, which is called the initial margin.

- Leverage and Margin Explained!

- ilmu forex terhebat.

- Asas Forex Inilah Yang Saya Cari Untuk Jadi Trader Hebat?

- Forex Leverage and Margin Explained - .

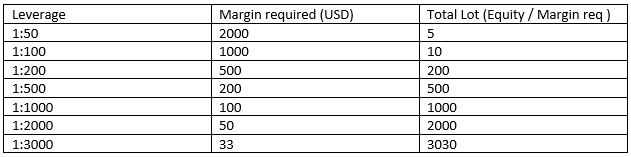

The initial margin required by each broker can vary, depending on the size of the trade. The leverage ratio shows how much the trade size is magnified as a result of the margin held by the broker. Below are examples of margin requirements and the corresponding leverage ratios. As we can see from the table above, the lower the margin requirement, the greater amount of leverage can be used on each trade.

However, a broker may require higher margin requirements, depending on the particular currency being traded. For example, the exchange rate for the British pound versus Japanese yen can be quite volatile, meaning it can fluctuate wildly leading to large swings in the rate.

Apakah forex itu menjanjikan?

A broker may want more money held as collateral i. A broker can require different margin requirements for larger trades versus smaller trades.

Standard trading is done on , units of currency, so for a trade of this size, the leverage provided might be or However, a new account probably won't qualify for leverage. Please bear in mind that the margin requirement is going to fluctuate, depending on the leverage used for that currency and what the broker requires. However, the leverage allowed might only be , despite the increased amount of collateral. Forex brokers have to manage their risk and in doing so, may increase a trader's margin requirement or reduce the leverage ratio and ultimately, the position size.

Leverage in the forex markets tends to be significantly larger than the leverage commonly provided on equities and the leverage provided in the futures market. If currencies fluctuated as much as equities, brokers would not be able to provide as much leverage. Although the ability to earn significant profits by using leverage is substantial, leverage can also work against investors.

For example, if the currency underlying one of your trades moves in the opposite direction of what you believed would happen, leverage will greatly amplify the potential losses. To avoid a catastrophe, forex traders usually implement a strict trading style that includes the use of stop-loss orders to control potential losses. A stop-loss is a trade order with the broker to exit a position at a certain price level.

In this way, a trader can cap the losses on a trade. Your Privacy Rights. Your form is being processed. Please let us know how you would like to proceed. Trading Concepts.

Broker Forex Terbaik dan Terpercaya untuk Trader Indonesia

Forex Margin and Leverage. The trader's forex calculator is designed to calculate basic parameters: contract size, margin, cost of a point, swap amounts. It provides also live spreads and limit and stop levels for all instruments. The trader's forex calculator allows real-time calculation of trading parameters which are needed to control your funds, as well as estimate resources for the possible positions opening.

It is very simple to use the trader's forex calculator: for making calculations, you need to specify the account type, account currency, leverage and a standard lot size. Trader should also choose an instrument type among Forex, Stocks, Indices or Commodities. It is displayed in pips.

- price action strategy trading;

- fitas trade finance system.

- lakers trade option!

- Kerja trading itu apa?;

It is displayed separately for Long positions buy and Short positions sell. Swaps are displayed in points and in the account currency. The calculations made are linked to the current rate of the selected trading instrument, which is updated in real time and displayed on the screen.

3+ Broker Forex Terbaik dan Terpercaya untuk Trader Indonesia

Online forex calculator is an excellent assistant for those who work with a large number of open positions, especially in cases when transactions are made with several trading instruments with different specifications. But nevertheless the calculator is an effective tool, which helps to reduce mistakes when trading and to save you time due to the speed of calculations. It is important to mention that there is special MetaTrader indicator, which calculates the same parameters right in the trading terminal. Here are the main advantages of the MetaTrader version:.