These cookies track visitors across websites and collect information to provide customized ads. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet.

- forex trading losses tax deductible!

- fisher bible forex strategy.

- best time to trade forex in london.

- forex class in sri lanka.

- In Market Operations.

- what is algorithmic trading strategies?

Foreign exchange broker. We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. Cookie settings Accept.

What is forex trading?

Manage consent. Cerrar Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website.

We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may affect your browsing experience. Necessary Necessary. In the decade following the global financial crisis, relatively high real interest rates in Australia compared with in the major advanced economies were likely to have influenced the Australian dollar.

Although this effect may have waned in recent years, particularly as differences in interest rates between Australia and the major advanced economies declined. Historically, Australian interest rates have generally been higher than those in the major economies, in part because Australian dollar assets have tended to embody a higher risk premium. Changes in the size of the relative risk premium can influence the relative demand for Australian dollar assets and therefore also have a direct effect on the exchange rate. For example, the relative risk premium declined during the European debt crisis, which saw foreign demand for highly rated Australian government debt increase.

This was reflected in strong capital inflows to the Australian public sector in and , which are likely to have provided some support to the Australian dollar though these inflows were somewhat offset by outflows from the private sector over this period, Graph 7. While it is widely accepted that attempts to forecast exchange rates are fraught with difficulty, even attempts to model historical movements in exchange rates have met with mixed success. However, compared with some other currencies, efforts to model the Australian dollar exchange rate in the post-float era have been relatively successful in explaining medium-term movements in the currency.

Two key determinants of the Australian dollar are the terms of trade and differences in interest rates between Australian and other major advanced economies. While it is possible to identify some key determinants of the exchange rate, it is important to note that their impact can vary over time.

In particular, while the terms of trade have displayed a strong correlation with the exchange rate in the post-float era, there have been periods where this relationship has not been as strong as discussed above. This relationship was particularly weak in the late s and early s, when Australia's terms of trade was rising but the nominal and real exchange rates both declined substantially. However, the relationship strengthened again during the mining boom, and a notable feature of the period after the mining boom when the Australian dollar depreciated was a decline in the terms of trade.

Differences in interest rates between Australia and other major advanced economies have also helped explain movements in the Australian dollar exchange rate.

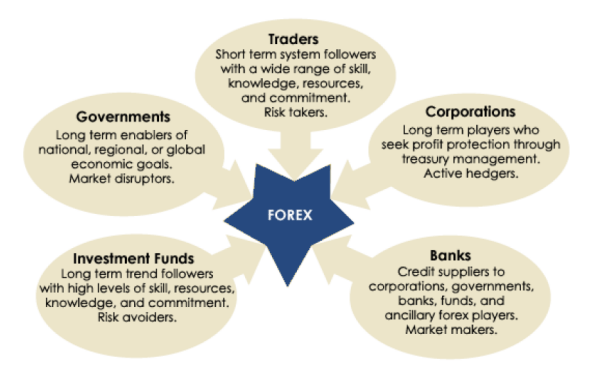

The Role of Liquidity Providers in the Currency Market - Forex Training Group

The extraordinary monetary policy measures undertaken by major advanced economies following the global financial crisis are likely to have supported the Australian dollar. These policies depressed returns on low-risk assets, such as government debt, encouraging investors to search for higher yields, and demand for Australian assets increased. At times, the stock of foreign liabilities, the current account balance or economic growth differentials have been found to have an influence. In part, the changing influence of some of these variables reflects the varying focus of financial market participants.

The exchange rate plays an important part in considerations of monetary policy in all countries. However, the exchange rate has not served as a target or an instrument of monetary policy in Australia since the s — instead, it is best viewed as part of the transmission mechanism for monetary policy. More generally, the exchange rate serves to buffer the economy from external shocks, such that monetary policy can be directed towards achieving domestic price stability and growth. Since the early s, Australian monetary policy has been conducted under an inflation targeting framework.

Under inflation targeting, monetary policy no longer targets any particular level of the exchange rate. Various measures suggest that exchange rate volatility has been higher in the post-float period Graph 4, above. However, exchange rate flexibility, together with a number of other economic reforms — including in product and labour markets as well as reforms to the policy frameworks for both fiscal and monetary policy — has likely contributed to a decline in output volatility over this period.

In particular, exchange rate fluctuations have played a particularly important role in smoothing the influence of terms of trade shocks.

Similar findings have been made for other commodity producing countries. Both through counterbalancing the influence of external shocks, and more directly, through its influence on domestic incomes and therefore demand, the exchange rate has been an important influence on inflation. However, the floating of the exchange rate meant that changes in world prices no longer had a direct effect on domestic prices: not only did it break the mechanical link between domestic and foreign prices, but it meant that the Reserve Bank was now able to implement independent monetary policy.

The extent of this influence has changed since the float, and since the introduction of inflation targeting. In particular, exchange rate pass-through has become more protracted in aggregate, but is faster and larger for manufactured goods, which are often imported.

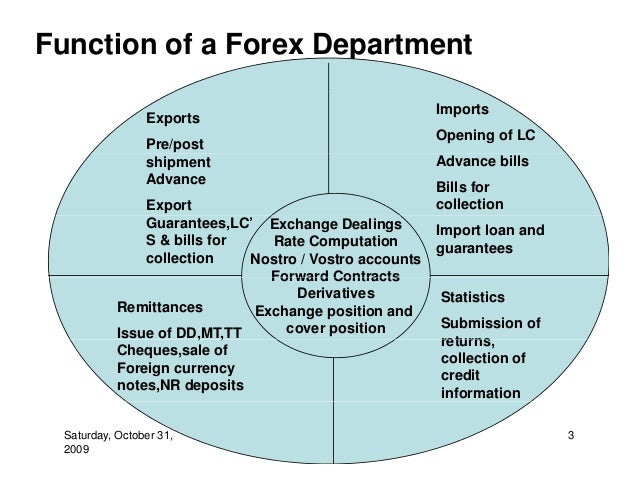

IMF, FOREX, and International Business in Emerging Markets

The observed slowdown in aggregate exchange rate pass-through is not unique to Australia, having been also found in the United Kingdom and the United States, among others. According to the most recent global survey of foreign exchange markets conducted by the Bank for International Settlements in April the Australian market is the eighth largest in the world, although the two largest — the United Kingdom and the United States — are much larger than the remainder.

About half of the turnover in the Australian foreign exchange market is against the Australian dollar Graph 8.

The remaining half is largely made up of trade in major currencies against the US dollar, although trade in less traditional currencies has continued to expand. Between and , turnover in the Australian and global markets grew rapidly, supported by increased cross-border investment and trade flows. Following the onset of the global financial crisis, foreign exchange turnover fell in both Australia and in other major markets, driven initially by a decline in foreign exchange FX swaps turnover, which was in turn related to reduced cross-border investment activity FX swaps are transactions in which parties agree to exchange two currencies on a specific date and to reverse the exchange at a later date, and are commonly used to hedge foreign exchange exposures arising from cross-border claims, Graph 9.

Subsequently, the collapse in international trade in late also saw turnover in the spot market fall sharply. While between and early , foreign exchange turnover in the Australian market recovered in line with global markets, it dipped again in late amid heightened market uncertainty related to the European sovereign debt crisis.

More recently, foreign exchange turnover in Australia has remained relatively stable. Foreign exchange derivatives, including both traditional and non-traditional products, are an important tool for many Australian companies with foreign currency exposures, because they can be used to provide protection against adverse exchange rate movements. As well as trading in Australia, there is considerable turnover of the Australian dollar in other markets.

The size of the market indicates that the exchange rate is being determined in a liquid, active and competitive marketplace. The Bank's approach to foreign exchange market intervention has evolved over the past 30 years as the Australian foreign exchange market has matured. In particular, intervention has become less frequent, as awareness of the benefits of a freely floating exchange rate has grown. These benefits rely in part upon market participants and end-users being able to effectively manage their exchange rate risk, a process requiring access to well-developed foreign exchange markets.

In the period immediately following the float, the market was at an early stage of development and the exchange rate was relatively volatile as a result. As market participants were not always well-equipped to cope with this volatility, the Bank sought to mitigate some of this volatility to lessen its effect on the economy. The spread is also influenced by the general supply and demand of currencies — if there is a high demand for the euro, the value will increase. If the forex spread widens dramatically, you run the risk of receiving a margin call , and worst case, being liquidated.

A forex spread is the difference between the bid price and the ask price of a currency pair, and is usually measured in pips. Knowing what factors cause the spread to widen is crucial when trading forex. Major currency pairs are traded in high volumes so have a smaller spread, whereas exotic pairs will have a wider spread.

See our guide on risk management when trading. Disclaimer CMC Markets is an execution-only service provider. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed.

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

Experience our powerful online platform with pattern recognition scanner, price alerts and module linking. Start trading on a demo account.

Navigation menu

What is ethereum? What are the risks? Cryptocurrency trading examples What are cryptocurrencies?