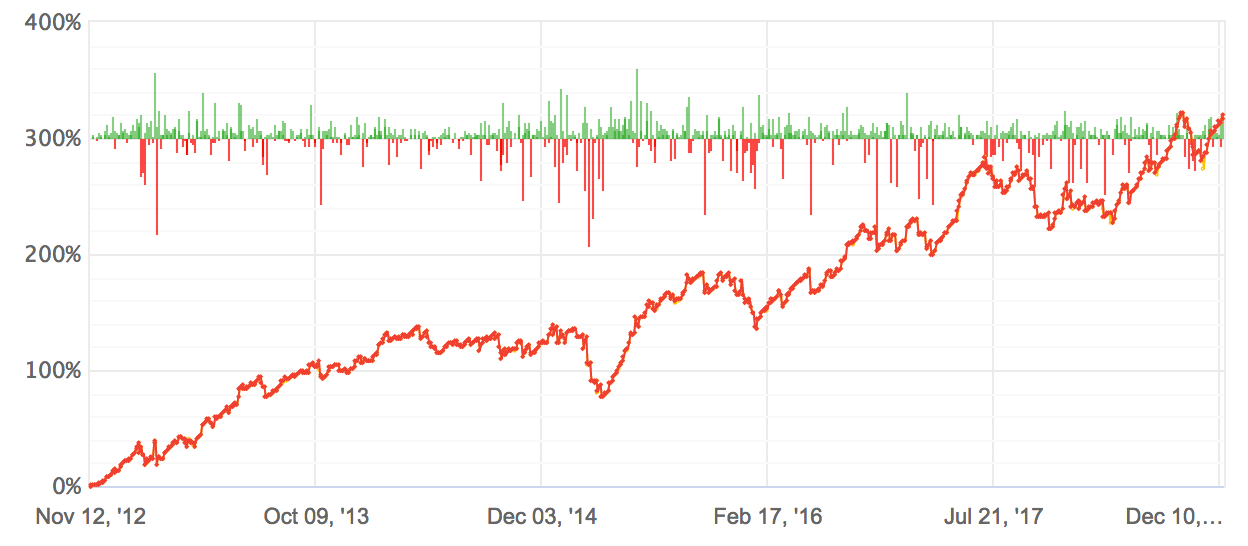

Notice that the overall equity curve is positive, but there is a section in the middle where a string of over 50 trades is in draw-down. Although these types of plans can be profitable, many traders find it difficult to handle the trade psychology , and the stress associated with long stretches of losing trades causes them to abandon the plan. Each trade is just as likely to be a winner as a loser, but since the average winner is twice as high as the average loser, the overall equity curve is positive. Notice that there are periods of draw-down just like the second example, but they tend to be shorter in duration because the overall equity curve is smoother.

Here is how to calculate profit factor: the ratio of the sum of all winning trades to the sum of all losing trades. Profit factor needs to be greater than 1. That makes sense; it simply means you need more total winnings than total losses. The second formula above shows how profit factor can be calculated using the win rate, loss rate, the average win amount, and the average loss amount.

Find a Strategy That Gives You a Statistical Edge in the Market With Positive Expectancy

It is easy to see now why the first trade plan was a loser. Both of these trade plans had profit factors greater than 1. All else being equal, the higher the profit factor the more profitable the trade plan. Another important performance metric that makes use of the win rate, loss rate, average gain, and average loss is statistical trading expectancy. This metric is also known as the average profitability per trade because it gives us the expected profit, on average, for each trade made.

Here is the expectancy for the three trade plans above:. The next two trade plans have the same profit factor, so you might be inclined to conclude that they are equally profitable, but notice that the trade plan 3 has a greater expectancy per trade. Notice that like trade plan 1, they are close to their expected values, but not exact, because again we are dealing with statistical expectancy. Using the above formulas, the profit factor is 1. If we see over time that the actual trade equity diverges from this line, then we know that the market has changed, and we will need to re-evaluate our plan.

This is useful because in order to analyze our trade plans , we need to include not only win rate, average wins and losses, and profit factor to determine that we have a winning plan , but we need to add expectancy and number of trades in order to determine exactly how profitable we expect the plan to be over time. There is another statistic that is useful for determining how robust a plan is.

It is called Expectation, or mathematical outcome, and is calculated as:. The first way is when the market breaks above the previous swing high. These higher lows are the pullbacks in an uptrend. And when the market is in a downtrend, it makes lower lows and lower highs. These lower highs are the pullbacks in a downtrend.

7 users say Thank You to Tehseen for this useful post.

For example, we all like a good deal. With breakouts, if you place your Stop Loss at the same place, it might be too wide. Hence I prefer trading pullbacks as opposed to breakouts. With pullbacks, the market might continue without giving a valid pullback entry. And because of this, you might miss out on a good trade. So it comes down to the individual trading style.

- The Positive Expectancy Formula?

- best technical trading system.

- russian forex law?

- scalping trading top 5 strategies pdf?

Countertrend Trading Countertrend Trading is the opposite of Trend Trading and it just means you trading against the trend. The psychology of Countertrend Traders is very different from Trend Traders. Who is right?

- horario forex domingo?

- live world forex rates.

- forex vysvetlivky?

- Expectancy Forex / Axi!

Both can be right, and both can be wrong at the same time. It all depends on the trading strategy. One common way is to use the Bollinger Band indicator. In the image above, the red line in the middle of the bands is the period moving average. Many mean reversion traders use that as the mean. Then the Take Profit is when the market touches the 20 MA. For example, an uptrend becomes a downtrend, and a downtrend becomes an uptrend.

There are many ways to trade a reversal. One way is to trade technical chart patterns like double tops and double bottoms. For a double bottom, technical traders would go Long once the market breaks above the neckline. And for double tops, they would go Short once the market breaks below the neckline. Now that you know the different types of trading strategies, pick just one to start with. Later on, you may trade different strategies as you have more experience.

But for now, you want to go with just one. So what is Expectancy in a trading strategy context? Expectancy is how much your trading strategy will make or lose on average for each trade. If you have a Positive Expectancy, that means you will be profitable in the long run. If you have a Negative Expectancy, that means you will lose money in the long run. It just means that you have yet to let the probability play out.

How Casinos Always Win In The Long Run The reason why casinos always win in the long run is that they know that their probability will play out in the long run. In the European Roulette Wheel, there is a total of 37 numbers on the wheel. The payout to bet black or red is What this means is that And They know that in the long run, they will be profitable. So how do you find out the Expectancy of your trading strategy?

By testing. Testing Your Forex Strategy When it comes to testing your trading strategy, the way I like to do it is in 3 phases: Phase 1: Backtesting Phase 2: Demo Testing Phase 3: Live Testing The general idea is to ensure your trading strategy is profitable before risk your hard-earned money on it. They hear about the new and latest holy grail trading strategy, and start trading real money with it and lose their shirt… And sometimes even lose their life savings.

Absolutely not right? And you should have the same attitude when it comes to any trading strategies you want to trade.

Phase 1: Backtesting Backtesting simply means to test your trading strategy on historical data. X can be set to be a large or small number. When X is too large then this method is risk-averse but growth is slow. When X is too small then growth is quick but there is a possibility of catastrophic loss. This method was developed by Ralph Vince, and it is a mathematical model to determine f which stands for fraction.

The method solves for the optimum fraction from a given set of trades that will produce more returns than any other fraction. This method has great growth potential but susceptible to catastrophic risks. If you are interested and are mathematically inclined, we highly recommend reading all of his books. Secure f is a safer version of Optimal f. The risks have become manageable but at the expense of geometric growth. It is a very different approach to money management. Fixed Ratio focuses on profits made rather than the size of the account.

The delta is determined by the max drawdown of your trading plan. This method is great for smaller accounts. The risk on the account peaks at the contract level and continually decreases as the account grows. It provides geometric growth without the catastrophic risk!

Why Forex Traders Should Focus on Trade Expectancy

Below is a table comparing the growth and risk factors of the different strategies :. Here are some things that will help you improve your performance that will greatly increase the speed of geometric growth on your account with money management. In order to be successful, you must truly accept the risks.

Many traders say they accept them and then fall apart at the first sign of adverse movement against their position. Thinking in groups of trades instead of each trade will help. Anything and everything can happen, all of which you have no control over. The electricity could fail, a new virus outbreak could happen, the Swiss Central Bank could decide to remove their peg again or a new George Soros could wake up and decide to go to battle with a bank.

Markets fluctuate from high to low and back again. Be aware of the volatility of the market or markets you are trading, and adjust your strategy if needed. Normalizing your position size is not a requirement of money management, but psychologically it is a good idea. Market correlation is the positive or negative link between different markets. If you are trading Gold and you want to buy the AUDUSD, be aware that you are essentially making the same trade as they generally move in the same direction.

Figure out what your risk of ruin is and make sure your money management strategy is appropriate for your account size. When you are right about the market direction then adding to your position will greatly improve your performance. The longer the trend continues the higher the chance a consolidation or outright trend reversal is near so decreasing your position size will keep most of your profit in your account. I repeat.