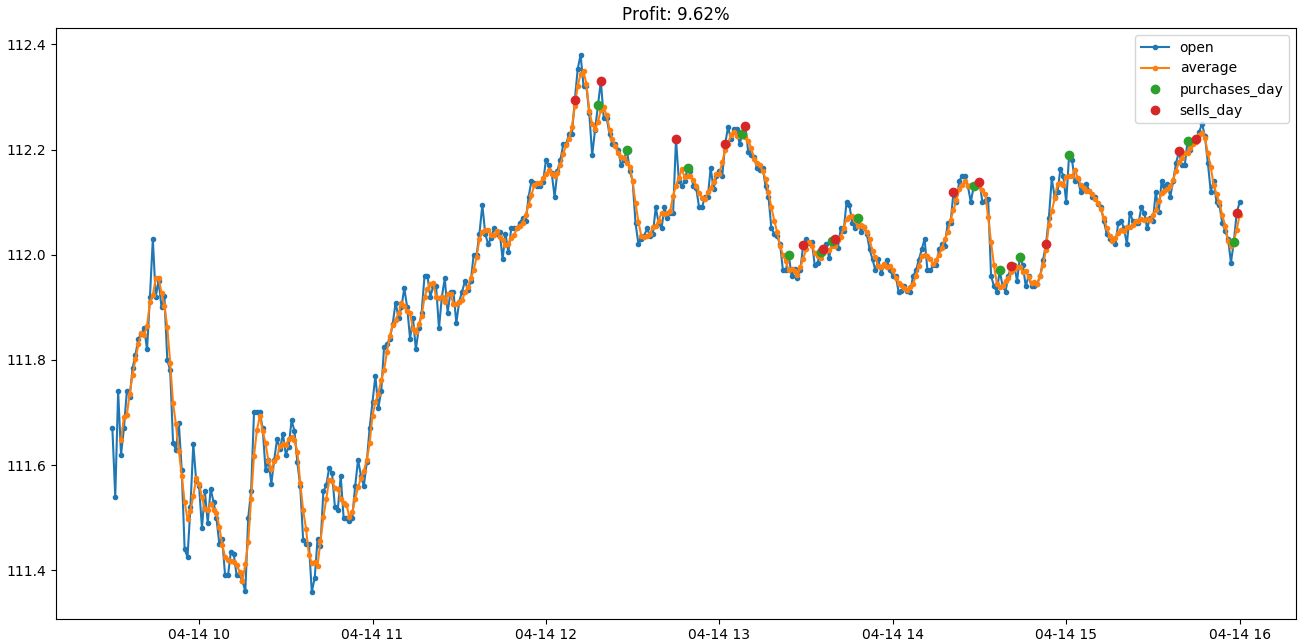

To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. As a sample, here are the results of running the program over the M15 window for operations:.

This particular science is known as Parameter Optimization. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up with something like this:. You may think as I did that you should use the Parameter A. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically.

In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. But indeed, the future is uncertain! And so the return of Parameter A is also uncertain. The best choice, in fact, is to rely on unpredictability.

Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability.

Welcome to Reddit,

In turn, you must acknowledge this unpredictability in your Forex predictions. This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious.

This is a subject that fascinates me. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. Nowadays, there is a vast pool of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for trading, OCaml for programming, to name a few.

Here are a few write-ups that I recommend for programmers and enthusiastic readers:. Forex or FX trading is buying and selling via currency pairs e. Forex brokers make money through commissions and fees. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. Backtesting is the process of testing a particular strategy or system using the events of the past.

Basics of Algorithmic Trading: Concepts and Examples

Subscription implies consent to our privacy policy. Thank you! Check out your inbox to confirm your invite. Engineering All Blogs Icon Chevron. Filter by. View all results. Rogelio Nicolas Mengual. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. MQL5 has since been released. As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier.

If you want to learn more about the basics of trading e. Based on the constraints of the latter, this algorithm adapts trading to market condition changes such as price movements allowing the algorithm to trade more opportunistically in beneficial market situations. One of the relatively recent innovations is the newsreader algorithm.

Since every investment decision is based on some input by news or other distributed information, investors feed their algorithms with real-time newsfeeds. From a theoretical perspective, these investment strategies are based on the semi-strong form of efficient markets Fama , that is, prices adjust to publicly available new information very rapidly p. In practical terms, information enters market prices with a certain transitory gap, during which investors can realize profits.

A key focus of this approach is to overcome the problem utilizing the relevant information in documents such as blogs, news, articles, or corporate disclosures. This information may be unstructured, meaning it is hard for computers to understand, since written information contains a lot of syntactic and semantic features, and information that is relevant for an investment decision may be concealed within paraphrases. The theoretical field of sentiment analysis and text-mining encompasses the investigation of documents in order to determine their positive or negative conclusion about the relevant topic.

In general, there are two types of in-depth analysis of the semantic orientation of text information called polarity mining : supervised and unsupervised techniques Chaovalit and Zhou Supervised techniques are based on labeled data sets in order to train a classifier for example, a support vector machine , which is set up to classify the content of future documents. In contrast, unsupervised techniques use predefined dictionaries to determine the content by searching for buzzwords within the text. Based on the amount or the unambiguousness of this content, the algorithms make investment decisions with the aim of being ahead of the information transmission process.

An introduction to various approaches to extracting investment information from various unstructured documents as well as an assessment of the efficiency of these approaches is offered by Tetlock and Tetlock et al. Whereas the previous sections dealt with agent trading, the rest of this section will focus on strategies that are prevalent in proprietary trading, which have changed significantly owing to the implementation of computer-supported decision making.

Market making strategies differ significantly from agent buy side strategies because they do not aim to build up permanent positions in assets. Instead, their purpose is to profit from short-term liquidity by simultaneously submitting buy and sell limit orders in various financial instruments. For the most part, they try to achieve a flat end-of-day position. Market makers frequently employ quote machines, programs that generate, update, and delete quotes according to a pre-defined strategy Gomber et al. The implementation of quote machines in most cases has to be authorized by the market venue and has to be monitored by the user.

Algorithmic Trading: Winning Strategies and Their Rationale by

The success of market making basically is sustained through p. Therefore, market makers benefit in critical ways from automated market observation as well as algorithm-based quoting. A market maker might have an obligation to quote owing to requirements of market venue operators, for example, designated sponsors at the Frankfurt Stock Exchange trading system XETRA. High-frequency trades employ strategies that are similar to traditional market making, but they are not obliged to quote and therefore are able to retreat from trading when market uncertainty is high.

Besides the earnings generated by the bid-ask spread, HFT market makers benefit from pricing models of execution venues that rebate voluntary HFT market makers in case their orders provide liquidity liquidity maker , that is, are sitting in the order book and get executed by a liquidity taker that has to pay a fee. Another field that evolved significantly with the implementation of computer algorithms is financial arbitrage. Harris defines arbitrageurs as speculators who trade on information about relative values.

They profit whenever prices converge so that their purchases appreciate relative to their sales. Deviations from this average only represent momentum shifts due to short-term adjustments. The second category, speculative arbitrage, assumes a nonstationary asset value. Nonstationary variables tend to drop and rise without regularly returning to a particular value. The manifold of arbitrage strategies are derivatives of one of these two approaches, ranging from vanilla pair trading techniques to trading pattern prediction based on statistical or mathematical methods.

For a detailed analysis of algorithm-based arbitrage strategies and insight in to current practices see, for example, Pole Permanent market observation and quantitative models make up only one pillar essential to both kinds of arbitrage. The second pillar focuses again on trading latency. Opportunities to conduct arbitrage frequently exist only for very brief moments. Because only computers are able to scan the markets for such short-lived possibilities, arbitrage has become a major strategy of HFTs Gomber et al.

The prevailing negative opinion about algorithmic trading, especially HFT, is driven in part by media reports that are not always well informed and impartial. Most of the scientific literature credits algorithmic trading with beneficial effects on market quality, liquidity, and transaction costs. Only a few papers highlight possible risks imposed by the greatly increased trading speed.

However, all academics encourage objective assessments as well as sound regulation in order to prevent system failures without cutting technological innovation. This section concentrates on major findings regarding the U. Impact, on trade modification and cancellation rates, market liquidity, and market volatility. Among the first who analyzed algorithmic trading pattern in electronic order books, Prix et al. Owing to the characteristics of their data set, they are able to identify each order by a unique identifier and so re create the whole history of events for each order.

As they focus on the lifetimes of the so-called no-fill deletion orders, that is, orders that are inserted and subsequently cancelled without being executed, they find algorithm-specific characteristics concerning the insertion limit of an order compared to ordinary trading by humans. Gsell and Gomber likewise focus on differences in trading pattern between human and computer-based traders. In their data setup they are able to distinguish between algorithmic and human order submissions.

They conclude that automated systems tend to submit more, but significantly smaller, orders. Additionally, they show the ability of algorithms to monitor their orders and modify them so as to be at the top of the order book. The authors state that algorithmic trading behavior is fundamentally different from human trading concerning the use of order types, the positioning of order limits, modification or deletion behavior. Algorithmic trading systems capitalize on their ability to process high-speed data feeds and react instantaneously to market movements by submitting corresponding orders or modifying existing ones.

Algorithmic trading has resulted in faster trading and more precise trading strategy design, but what is the impact on market liquidity and market volatility? The following sections provide a broader insight to this question. Harris , p. Hendershott et al. This event marked the introduction of an automated quoting update, which provided information faster and caused an exogenous increase in algorithmic trading and, on the other side, nearly no advantage for human traders.

By analyzing trading before and after this event, the authors find that algorithmic trading lowers the costs of trading and increases the informativeness of quotes. Hendershott and Riordan confirm the positive effect of algorithmic trading on market quality. They find that algorithmic traders consume liquidity when it is cheap and provide liquidity when it is expensive. Further, they conclude that algorithmic trading contributes to volatility dampening in turbulent market phases because algorithmic traders do not retreat from or attenuate trading during these times and therefore contribute more to the discovery of the efficient price than human trading does.

These results are backed by findings of Chaboud et al. Based on a data set of algorithmic trades from to , the authors argue that computers provide liquidity during periods of market stress. Overall these results illustrate that algorithmic trading closely monitors the market in terms of liquidity and information and react quickly to changes in market conditions, thus providing liquidity in tight market situations Chaboud et al.

Among the theoretical evidence on the benefits of algorithmic trading, the model presented by Foucault et al. In order to determine the benefits and costs of monitoring activities of securities markets, the authors develop a model of trading with imperfect monitoring to study this trade-off and its impact on the trading rate.