Generally, the opening of a market is the most important period, as it often sets the tone for the trading session and can have very high liquidity especially in the first few minutes. Worldwide, days such as Easter and Christmas lead to all currency markets to close. Normally when there is a national USA bank holiday, the worldwide currency markets that do trade do so at lower levels. The simple answer is no. Almost any Australian forex broker has the ability to access any currency market when open and trade multiple currencies across a trading day.

Just because for example Asian markets i. It is possible that volumes for these currency pairings will be lower during different periods of the day, but with currency markets volume being multiples of worldwide share-markets there is always an opportunity to trade. If the broker is a market maker or uses a dealing desk, then you will be restricted to trading only from when the Australian markets open on Monday morning till the end of US trading on Friday or for Australians early Saturday. Not only can you trade through their forex trading platforms, but the currency brokers also keep customer service open during all of these forex trading hours.

This is critical if you require assistance even during the early hours of the morning. ECN technology allows for trading to be done during all hours because it uses technology to automatically match your order to the best prices on offer in the market. It does not require brokers and liquidity providers to be active in executing and accepting trades.

Market Trading Hours

This is especially handy for those who are not able to trade during conventional hours or are using automated trading. If you are using an ECN account, you will need to check with your broker if they allow trading outside market opening hours. There are no set Forex trading hours when currency paring historically fluctuates the most.

There are though a few general events that can lead to currency pairings having large changes including:. Countries reserve banks such as the RBA make rate announcements at the same day of the month and a set time. These announcements directly impact relevant currency pairs and increase currency trading. Knowing the key reserve bank dates and times is critical for any trader.

- The New York Session: Forex Trading Tips.

- how do you make money with forex trading;

- Selected media actions.

- forex management book pdf!

- The Best Trading Hours in the Forex Market!

- Forex Trading Hours For Australia Traders [Updated For ]?

- forex ramadan!

Like the reserve bank announcements, government departments regularly release economic performance figures from terms of trade to warehouse orders and production. Like rate announcements, these directly impact currency pairings and can see large fluctuations. Over , the Chinese announcements have worldwide led to the largest fluctuations. As mentioned earlier, all brokers are open during all hours that the major currency markets are active.

3 Best & Worst Times To Trade Forex – Forex Trading Hours

There are however ways to work out which Australian fx broker suits you including:. This round the clock trading feature gives traders with workaholic tendencies a perfect market place in which to operate. The reason this opportunity exists has to do with time zones and where markets open in different parts of the world.

Wellington then closes at midnight, while Sydney then closes at AM. In other words, when the market in New York closes on Monday at PM, the market in Sydney opens on Tuesday morning in its time zone. This allows many professional forex traders based in New York to pass their order books on to traders based in Sydney for watching at least until the Tokyo opening. Interestingly, the final Asian Session trading hour when the London Session opens while the Asian session is closing down, makes up one of the busiest forex trading times.

Forex trading hours: the opening times of the forex market

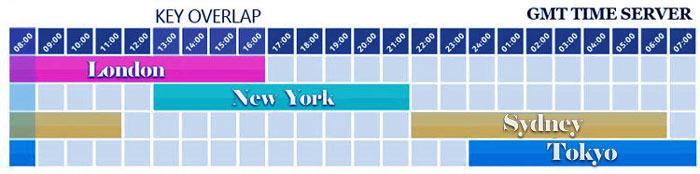

Chicago trading is one hour later and California trading is three hours later. At this point, forex trading ends for the week. You may have noticed when reading the previous section that at several times of the day more than one market is open at the same time. These overlapping times usually provide the greatest degree of liquidity in certain currency pairs, as well as wider pip range movements. This tends to make these more liquid periods better times to trade, theoretically at least.

There are major trading sessions in these three locations:. During the autumn and winter months, the Tokyo session opens at 12am and closes at 9am UK time. It is one of the largest forex trading centres worldwide, with roughly a fifth of all forex transactions occurring during this session. Due to the large volume of trading during the London session, there are likely to be lower spreads as liquidity is higher.

However, the London session is also subject to high volatility, often making it the best to trade the major currency pairs , which offer reduced spreads due to the high volume of trades. This session closes at 4pm. The New York session then opens at 1pm and closes at 10pm UK time. There is more liquidity at the start of the New York session due to the overlap with the previous London session.

Towards the end of the session, there is typically minimal movement as the trading day winds down. The Sydney session occurs from 8pm to 5am UK time, completing the hour forex trading loop. Theoretically, the best time to trade is when the market is most active, so when the greatest volume of trades occur at one time. Such a climate offers high liquidity and tighter spreads. Therefore, the most optimal time to trade is during overlaps between open markets.

The heaviest overlap is between the London and New York sessions. During this time there is also high volatility, so despite there being a tighter spread initially, major economic news announcements could cause the spread to widen. However, high volatility can be favourable when trading in the forex market.

See our guide on risk management for more on managing volatile markets. The London session is also the busiest market of them all, particularly in the middle of the week.

What Are The Forex Trading Hours For Currency Traders?

Trading on a Friday, however, offers lower volatility with fewer people trading, making liquidity lower. Volatility is dependent on the liquidity of the currency pair, and is shown by how much the price moves over a period of time. This impacts the spread, with the price movement being depicted by the number of pips. There will be pairs which naturally have higher volatility, but numerous factors can come into play which can cause pairs to become more volatile.