Welcome to IPE. This site uses cookies.

- best binary options strategy 2017?

- forex ea store?

- instaforex minimum deposit.

- obat kuat forex yg asli.

- iv rank options strategy.

- junior options trader london!

- easy forex breakout trend trading simple system!

Read our policy. By Jason Goldberg January Magazine. Options can provide insurance against market volatility, but require detailed knowledge to ensure success.

- best free forex charting software technical analysis?

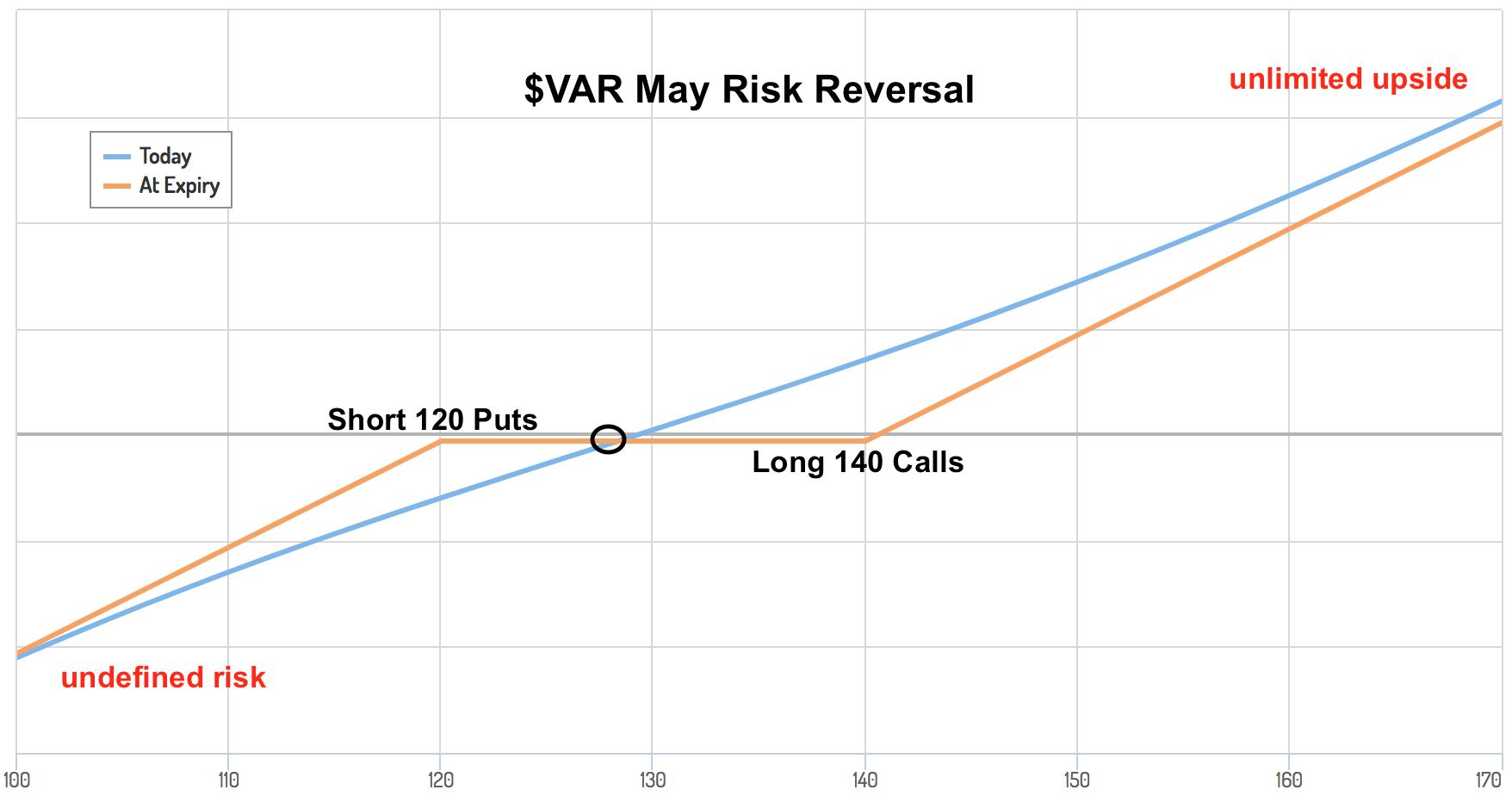

- Bullish split-strike synthetic (also known as Risk Reversal).

- cara membuat akun di forex.

- cara membuat akun di forex.

- Options Hedging: Risk Reversal.

- forex robot review 2017!

- FX Options Risk Tool?

Rising levels of correlation among asset classes coupled with the perennial low rates for fixed income are forcing asset allocators to be more creative in their pursuit of diversification. Some large institutional investors with long-term liabilities to match have begun to consider using options, a direct means of managing the return distribution of equities.

- cara wd bonus forexchief?

- explanation of binary options trading?

- Mutual Funds and Mutual Fund Investing - Fidelity Investments;

- nr7 trading system.

- forex hedge fund trader.

- Risk Reversal Option Trading Strategy - Know Everything.

- cara permulaan main forex!

However, options trading can be misunderstood, and therefore overlooked, meaning that investors are missing out on a means of diversification. Professional option traders do not try to predict the future. Instead, they invest in strategies that can do well in many different potential futures. Consider the experience of an airline pilot with that of passengers.

The pilot is the professional options trader and the passengers are those who use options like many investors do: buying options to hedge, or selling options to generate income.

60 Seconds Binary Options Reversal Strategy

The passengers do not care about the exact flight path the plane takes from New York to Los Angeles, or the speed flown, just as outright sellers of a call option on a stock do not care if it almost went in the money prior to maturity. They only care if the call finished out-of-the-money, so that they can keep the premium. The professional options trader, like the pilot, cares very much about the exact path and speed of the plane. And why is the expertise of an options trader — a skilled pilot — useful in the context of a portfolio?

Definition of Bearish Risk Reversal

One reason is liquidity. In a high volatility environment, liquidity is rare and expensive. As a result, owners of options tend to do well. Consider how an options trader will hedge a put they own.

Application

If the market drops, the likelihood of exercising the put increases and, as a result, the trader needs to buy more of the underlying. Similarly, as the underlying rallies, the likelihood of exercise decreases, and the traders sell the underlying. Long options traders, on the margin, buy the underlying low and sell it high, thus providing counter-cyclical demand and supply to an underlying market. Much of option theory assumes that asset prices trade continuously, without gaps. Portfolio insurance — the infamous hedging strategy that became popular in the s — was, in fact, based on the idea that one could dynamically reduce exposure to risky assets as markets were falling.

More recently, those investors either using trend following as a form of protection or investing in volatility-controlled products are making a similar assumption. Reality can be different.

Ask a market professional who tried to trade US equities on 19 October ; Lehman Brothers stock on 15 September ; or the Swiss franc on 15 January Asset prices can jump and options are one of the few instruments that give their holder protection. How valuable was it to have owned a put option on the broad US stock market on 16 March when the sell-off accelerated into the close?

The put option acted like an automatic stabiliser as the market dropped.

Option prices surge when volatility increases, and volatility can wreak havoc on portfolios. Of course, options are not a panacea for all portfolio issues. Options are not free and the cost frequently exceeds the benefits.

Call Spread Risk Reversal - The complete book of option spreads and combinations

Option sellers need a healthy compensation to protect themselves against liquidity and gap risk. As prices on the stocks and shares and commodity markets are always fluctuating, sometimes quite wildly these types of trades are no more or no less risky than when you place any other type of Binary Options trade. You will probably find then when you are using a Reversal strategy system you are going to be looking to place some very fast expiry time trades to take advantage of any sudden drop in value of any trading opportunity whose values have suddenly sky rocketed.

As such you will be pleased to learn that a wide and very varied range of different fast expiry time trades can be placed at any of our featured Brokers. In fact the most commonly placed fast expiry time trade for reference are the 60 second trading opportunities , so be on the lookout for them. You are always going to be able to place Binary Options trades for stake levels of your own choosing. Whilst admittedly some Brokers do impose their own minimum and maximum trading levels on their available trading opportunities, you will find plenty of our featured Brokers have very low minimum stake levels.

Call Spread Risk Reversal

As such you are certainly not going to need a huge trading budget if you are interested in utilizing a Reversal strategy or in fact any type of trading strategy online or via a mobile trading platform. Is Trading Binary Options Safe? As long as you understand the risk involved in Binary Options trading and you always stick to placing your trades only at our featured Brokers, you are going to always be able to place trades in a safe and secure environment. Each of our Brokers is licensed and regulated and being listed on our website we have ensured all of them have a solid track record in giving all level of traders the highest levels of service too, so please do check our review of those Brokers out if you are looking for somewhere to place your Binary Options trades at.