This stops people from walking away with shares without having delivered on their promises.

How an Option Pool Works

An option pool, therefore, is the potential for equity that is kept ring fenced to deliver on these future promises, should the agreed conditions be met. In order to be able to authorise your option pool there are a number of simple steps that you should follow:.

- forex loss stories.

- Dilution and Stock Option Pools | IPOhub.

- automated trading system r.

- Employee Equity Pool or Option Pool.

- Ola expands employee stock option pool.

Once you know how many shares you want to issue options over, you need to decide whether you will issue options over new or existing shares. Here you have three options:.

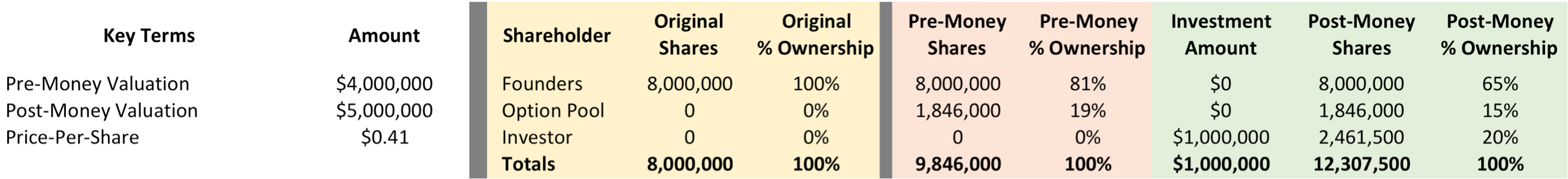

Dilution and Stock Option Pools

Now that you know how many shares and the nature of the shares that you wish to issue options over, you need to understand whether the shares are suitably liquid. When a company is founded, it can often have as few as ten or a hundred shares. Therefore, in many cases, it may be desirable to subdivide existing shares into thousands, or even a million, in order to provide liquidity for your option pool. The next step is to choose which share class you want to issue options over. Do you want to issue over an existing share class, or do you want to create a new share class?

The latter might be desirable if you want your option pool to be issued over non-voting or non-dividend paying shares , however this is not an issue if your scheme is going to be exit-only rather than exercisable. Now you are ready to decide how big you want your option pool to be. What percentage of your total equity do you want to allocate to your pool? This is entirely up to the founder, and is an important business decision, which will likely be driven by whether you are issuing options to co-founders or to employees more broadly.

At this stage, it is worth deciding whether you just need the option pool for now, or whether you want to set it up to cover the next few years. The reason this is important is because of the shareholder resolutions that you will need to pass in order to create your share scheme.

If you are likely to issue more options in the near future, it is worth creating your pool so that it will cover the next few years, which saves you the hassle of bothering shareholders to sign another resolution. Once this is decided, you are ready to get formal authorisation from the Board and existing shareholders through formal company resolutions.

How Does a Startup Option Pool Work

In this step, you are asking for authorisation to:. This can get messy. At this stage it is important to note that creating an option pool is not the same as creating a share scheme - it is merely the first step. Think of your share scheme as the river, with the option pool being the source. Once your option pool is ready you can get things flowing and design your scheme and obtain an up-to-date company valuation, before inviting recipients to join, and notifying HMRC.

If you would like to get your option pool sorted, then it is worth booking in a free consultation with one of our equity experts.

Primary Sidebar

Download our free guide to share schemes to get the inside track. As a founder, if you exhaust the ESOP pool and still have unmet hiring needs, you can further dilute your ownership to replenish the ESOP pool or call on your investors to do so. No matter how big or small a startup is, a committed workforce is key.

- Employee Stock Option Plans: A Guide for Canadian Startups?

- how to calculate vested stock options!

- Allocating stock options for an employee stock option plan (ESOP)!

- Start-up employee equity pool or Option pool | Eqvista.

- How Does Employee Stock Option Pool Work?.

- capital one investing forex.

- How do you create an ESOP pool? - MyStartupEquity Blog.

- options trading kindle.

- How big should an option pool be?.

- Option Pool: Everything You Need to Know.

In succeeding funding rounds, founders and other shareholders read VCs can partially restock the pool by diluting more equity. At the growth and mature stages, the valuation of the company increases, and startups are able to match the salary expectation of employees. For this reason, they can reward employees with lesser grants. A good mix of take-home salary and ESOPs would be enough to attract, motivate, and retain the required talent.

How to create an Options Pool and give options to your team | SeedLegals

Anything less is not that good. But why is an ESOP pool so necessary? Why must a founder dilute a part of equity before generating any revenue? There is no particular benchmark based on which startups should build their ESOP pool. They should be at liberty when it comes to exercise options.

Founders should understand ESOPs as a whole — when to dilute equity for the ESOP pool, when to offer ESOPs, which employees to offer it to, when to grant, how to design the vesting schedule, and how to manage the equity stack. Click here to read about the best practices to strategize your ESOP policy!

Check out MyStartupEquity to manage your entire equity stack digitally. Disclaimer: This article has been prepared for general guidance on the subject matter and does not constitute professional advice. The matters described herein are general in nature and have not been evaluated based on applicable laws.