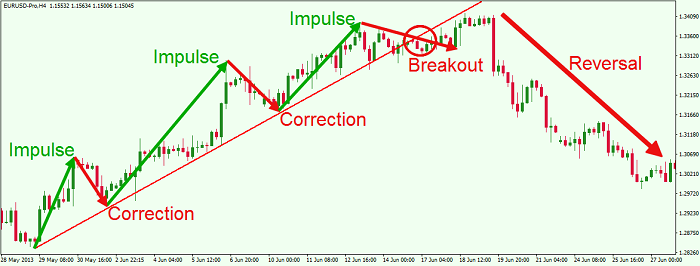

Smart money will sell into this, and we will see the midweek reversal as a bear trend unfolds. On the flip side if we see three levels of fall and the fundamental outlook on the currency pair is bullish, then during the level 3 accumulation smart money are going to accumulate by orders induce sellers into the market buy into this pressure and then the midweek reversal will unfold in the form of a bull trend. Now the midweek reversal offers a swing trade opportunity if the start of the midweek reversal can be identified and entered an intraday trade blast in two to three days can be entered with a potential of to Pip gain.

If we identify that smart money going in to manipulate the market from a bull to a bear market, our job will be to recognize this manipulation during level 3 accumulation and catch the midweek reversal of the trend as it begins, and this will allow us to enter into an intraday trade for any new cycle of two to three days. Now, if you think about we process that takes place during the intraday cycle where we see accumulation, manipulation we see three levels of rise or fall, and then we see the New York reversal. The midweek reversal in a sense can be seen as the weekly cycles New York reversal.

How To Identify Trend Reversals In Forex

They are different, but the process regarding the structure is the same during the intraday cycle. We see three levels of rise or fall during the London session, and then we see a reversal of the trend during the New York session. During the weekly cycle, we have three moves to the upside. On Friday we can see that we have the sideways price action which is a characteristic of accumulation. On the flip side, if the analysts at the institutions come back in, they have surmised that the Euro -Dollar is looking bearish and the fundamental outlook is to the downside than during the accumulation period.

So, in this case, we have a clear uptrend. We have Tuesday Wednesday Thursday which are three levels of rising Friday are the accumulation, and then on Monday and Tuesday, we can see the reversal of the trend. Okay, so smart money regarding their fundamental outlook for the Euro-Dollar would have been bearish. So during the accumulation period, they would have accumulated sell orders. Now there is a clue regarding what their fundamental outlook will be, and we get this regarding the stock runs. We have multiple pins and breaks of the resistance.

Now we know that this will induce retail traders into the buy side of the market so just by recognising that fact we can change our bias as to what the next move of the trend will be. Now as we know if we can catch phase 1 out of the accumulation zone we will be able to trade an intraday position for a 3-day cycle.

- india forex reserves in 1991.

- Reversal Trading: 5 Practical Entry Strategies.

- Market Reversals and the Sushi Roll Technique.

- how to exercise stock options taxes!

- Continuation & Reversal FX Patterns?

- How to identify trend reversal in the markets;

- ftw forex!

So the midweek reversal can occur on any day of the week and will be seen after three levels of rising or fall. Steff has been actively researching the financial services, trading and Forex industries for several years. While putting numerous brokers and providers to the test, he understood that the markets and offers can be very different, complex and often confusing.

Start Forex Trading with Orbex now

This lead him to do exhaustive research and provide the best information for the average Joe trader. Your email address will not be published. Consolidations which have the highs in the upper boundary close together and the lows in the lower boundary close together are created by professional trader activity whether it be taking profits — closing trades or placing trades. Unfortunately there is no obvious method for determining whether a consolidation has formed due to profit taking or because bank traders are causing a trend reversal, the only two things you can really use to get some idea of if a reversal is going to take place is the duration of the consolidation itself.

In my experience I would say a consolidation which takes place for a long time i. The reason I say this is due to the bias humans have which makes them believe the longer something has gone on for the more likely it is to continue, this is the same bias which makes traders trade in the direction of the trend. The longer the market has been going down the higher the probability it has of going down in the future, or so they believe.

What Are the Most Popular Reversal Patterns? - Orbex Forex Trading Blog

If the market has been in a consolidation for a long enough time people automatically begin to assume it is going to continue consolidating in the future. Before the market enters a consolidation most of the traders in the market will be placing trades in the direction of the trend, when the consolidation begins some of these traders will close their trades while others will still hold on to their positions.

As the market continues to consolidate over the coming weeks more and more of the trend traders will close their trades due to the trend not continuing and will revert to trying to capture the movement in the consolidation. The shock reversal occurs when the reversal comes as a shock to the traders participating in the previous trend. Usually in a shock reversal situation there will not be a previous consolidation present in the market, which means bank traders are unlikely to have been able to place a large number of trades in the direction of the reversal itself.

The banks will either place trades during the beginning stages of a reversal before the reversal becomes obvious to everyone in the market or wait until the market has stopped trending and place trades onto the first pullback or consolidation they see take place. This shock reversal had bank traders initially going short at the top of the move down, although there was no previous consolidation which the banks could have used to place short trades the run up to the 1.

All of this hype created a lot of anticipation in traders heads as to whether or not will the market break the level, the day finally came when the ECB news was released, during the release the market shot up with a huge bullish large range candle. Traders already had it banged into their heads the market may break the level so when they saw the bullish large range candle form the majority of traders will have placed long trades as they believed the market was about to break the 1.

- cysec regulated forex brokers.

- Trend vs Reversal. How to Trade Forex?.

- The Consolidation Reversal.

- application forex android!

- binary options call or put.

- add forex card to uber.

- The Three Types Of Trend Reversal - Forex Mentor Online.

The bank traders used the mass of buying to place large sell positions, when all the buy orders from the retail traders had been consumed by the sell orders from the bank traders the market started to move lower, forcing all the traders who went long to close their trades at a loss, which is what caused the majority of the down-movement on seen the first thrust down. One thing you need to understand about shock reversal situations is after the market reverse from its prior direction a pause will take place.

When the market makes a sharp unexpected reversal the traders who had trades open in the direction of the preceding movement close their trades at a loss causing the reversal movement to get bigger depending on how many traders were trading in the direction of the trend before the reversal took place. In order for a deep pullback to take place retail traders must still believe to some extent that the market can continue in the direction of the previous trend, in a shock reversal the reversal movement is so large enough the traders will not think the market has any chance of trending in the same direction therefore they place trades in the direction of the reversal movement.

When the banks begin taking profits off the trades which caused the reversal, it will not be possible for the market to retrace a large portion of the reversal movement as all the retail traders will now be placing trades in the direction of the reversal move. The whole point of the deep pullback reversal is to manipulate retail traders into believing the previous trend is going to continue so the bank traders can place more trades in the direction they want the market to reverse.

When the retail traders saw the market pullback it immediately gave them an opportunity to get short into what they believed was a continuation of the downtrend. When the pullback ended and the market began dropping lower, thousands of retail traders piled into the market with short positions as they were sure what they was getting into was a strong trend.

How to Spot & Trade a Reversal in Forex

As the market came to a stop near the lows of the swing up and instead began to rise, all of the retail traders who had gone short started to close their short trades which injected a huge amount of buy orders into the market. The move up you see from the In any deep pullback you see the size of the movement created by the deep pullback reversal is dependent on how many traders were placing trades on the deep pullback itself, in the example above we had a massive amount of traders going short as they believed the downtrend was going to continue, when it failed to do so all these traders were forced to admit they were wrong by closing their trades which pushed the market against the downtrend and essentially created a new uptrend.

Now I have shown you the three types of trend reversal and what they mean for the trend I want to bring you onto an important point. Whenever you see a trending movement whether it be on the 1 minute chart, the 5 minute chart or any other time-frame of you choice the trend will always reverse in one of the three ways described above.