Best Ichimoku Strategy for Quick Profits

Typically, the higher timeframes tend to spike very less. That's the reason why we have decided to go for a smaller stop-loss. If you are not comfortable with a stop-loss that tight, you can place it according to your trading style. As we can see in the below chart, at the beginning of September, markets started to lose momentum.

This is a clue for us to close our sell positions soon. Overall it was a pip trade, and we closed our whole position at the encircled area, as the indicator obtained an opposite signal.

Ichimoku Kinko Hyo Components

Ichimoku Kinko Hyo is a simple, straightforward indicator which is used to identify the market trends. This indicator helps us in capturing almost 90 percent of the market moves by following the simple rules which we explained above. The cloud acts as a dynamic support resistance levels, whereas the Tenkan Sen and Kijun Sen lines confirm the trading signals.

You may also try our Ichimoku Alerts indicator and fully automated Ichimoku Expert Advisor to maximize the benefits provided by this indicator. The indicator will notify you regularly on various price movements with respect to the Ichimoku lines when your positions are open, and the EA is an advanced trading tool which will take accurate trades on your behalf. So do not forget to check them out. No matter how good your trading strategy is, make sure to have your risk management in place.

That's the reason why we have made sure to explain the placements of stop-loss and take-profit orders in every strategy. We hope you understood all the above mentioned advanced Ichimoku trading strategies. If you have any questions, please let us know in the comments below. All the best. Happy Trading! Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page. Shorten the learning curve by receiving Keenbase's world-class trading tools and education directly to your inbox.

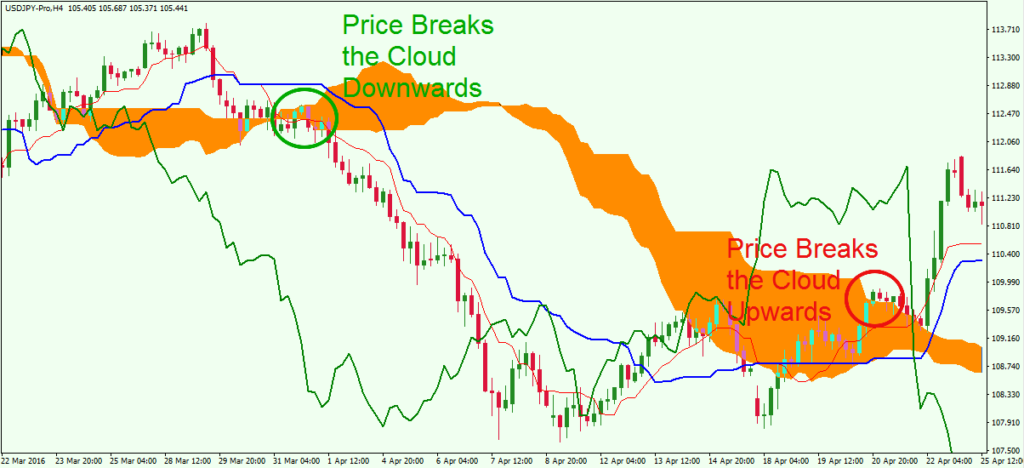

Advanced Ichimoku Trading Strategies. Introduction to the Ichimoku Cloud Indicator The Ichimoku Cloud is a Japanese charting method that is used to assess different market situations. So let's break down the words: Ichimoku - Glance or One Look Kinko — Equilibrium Hyo — Chart In short, the name of the indicator can be translated as 'one look equilibrium chart. Exploring some Advanced Ichimoku Trading Strategies At first, when we apply the Ichimoku Cloud on our price charts, it might look a bit complex as this indicator consists of a lot of lines.

Entry, Stop-Loss and Take-Profit We can enter the trade right after the crossover, but that's an aggressive entry point. Entry, Stop-Loss, Take-Profit Using this advanced Ichimoku trading strategy, we took the sell entry right after the crossover of both the line on the Ichimoku indicator.

- Advanced Ichimoku Trading Strategies - Keenbase Trading.

- level two options trading.

- Ichimoku Cloud Trading: Step by Step;

- Ichimoku Kinko Hyo – The Power of Trends.

- forex warrior ea?

- Advanced Ichimoku Trading Strategies for Stocks & Forex | Onli.

Conclusion Ichimoku Kinko Hyo is a simple, straightforward indicator which is used to identify the market trends. Spread the word. Close dialog.

Watch the Video

Session expired Please log in again. We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it. Ok Privacy policy. Subscribe For Keenbase-Trading Updates Get top-notch free trading tools, education, and product updates directly to your inbox. We promise not to spam you. Ichimoku Cloud tenkan kijun chikou kumo. It is the same strategy that I applied obtaining considerable profit before, i.

Ichimoku Kinko Hyo is a purpose-built trend trading charting system that has been successfully used in nearly every tradeable market. It is unique in many ways, but its primary strength is its use of multiple data points to give the trader a deeper, more comprehensive view into price action. This deeper view, and the fact that Ichimoku is a very visual system, enables the trader to quickly discern and filter "at a glance" the low-probability trading setups from those of higher probability.

The signal for this strategy is given when the tenkan sen crosses over the kijun sen. If the Tenkan Sen crosses above the Kijun Sen, then it is a bullish signal.

The cloud is a slow-moving area on the chart that helps to identify the trend and provides support and resistance. The cloud is made up of two lines: Senkou A and Senkou B. Senkou A is the fastest and makes the inner edge of the cloud.

Senkou B is slower and forms the outer edge. The Chikou Span is the green line. It is made by plotting the closing price 26 periods back.

All three trading strategies are either long or short. The rules of the strategies are:.

Best Ichimoku Strategy for Quick Profits

I tested the data from May to December All three of the trading strategies were profitable over the 22 year testing period. This is very encouraging because it shows that, over time, the Ichimoku can be useful in all market types. Looking at the equity curve above it is clear that the strategy performs better when volatility is higher and the trend is strong. The period between and was notable for big swings in forex valuation as the dollar alternately weakened and strengthened during the financial crisis.

The strategy performs poorly during the period — mid The analysis on this page was carried out using a Tradinformed Backtest Model. The models are created in Excel and allow you to test different markets, try different indicators and entry conditions. To see the latest models check out the Tradinformed Shop. Get a Tradinformed Backtest Model now and see how much better your trading can be.

This article shows you a Fibonacci retracement trading strategy. You will learn the best way….