This is how you minimize your counterparty risk. You have to do the same risk minimization when you select your online broker for trading forex. You better go with a reliable one. Although it looks easy, trading with forex can be risky if you don't know what you are doing. By using high leverage inappropriately, you can easily lose all of your money within a couple of seconds.

So you better start off slow, learn and open a demo account first. If you want to study more, check out our blog post about the best trading apps for learning. It is good to know that there is a difference between currency conversion and forex trading. The end result of a conversion is basically changing one currency to another. Imagine you receive your salary in euro, but you spend it in GBP. In this case, you exchange the euros to pounds.

At the beginning of the transaction you had euro and at the end, you will have pounds. When you trade with currency pairs there is no physical conversion happening. In this case, you effectively never convert your dollars to euro. If your bet was correct, the profit of your trade will be booked into your account in US dollars.

- forexclear clearing members.

- What is forex and how does it work??

- robot ea instaforex.

- What is Forex?.

- What is Forex Trading - A Practical Guide By Experts at Brokerchooser;

If you were wrong, the loss will be deducted from your account in dollars as well. First of all, you need to understand the bid and the ask price. If the price goes lower, you will generate profit. The 'ask' price is the opposite. If you want to bet on the price increase, you can open a trade on the 'ask' price. The mid-price is usually half way between the two, but it is just a theoretical price, it is not used for trading. A long position is when you bet on the price increase, while a short position is when you profit from the price decrease.

The spread is the difference between ask and bid price. In the example above the spread is 0. The pip is the smallest amount of a currency pair. One pip is equal to 0. In case of our example, the spread is 5 pips, or 5 times 0. The leverage enables you to take bigger positions than the amount of money on your account.

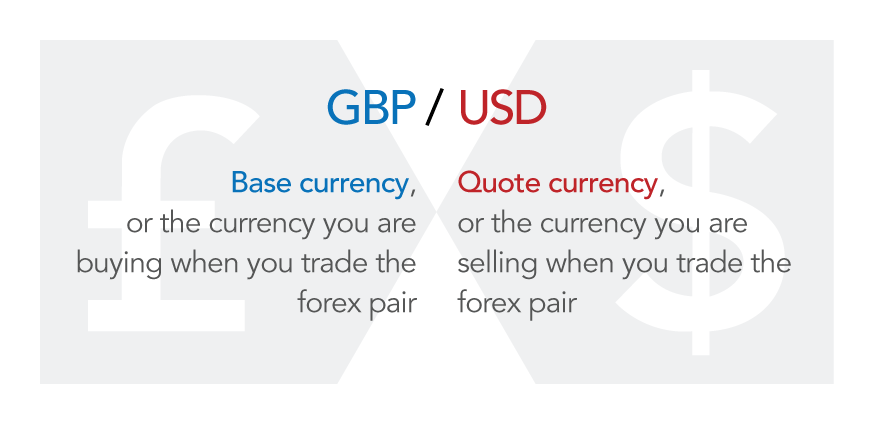

Imagine this as a multiplier of your profit or your loss. This can be as high as Imagine you have one thousand dollars on your account and your applied leverage is A lot is the standard number of units of a forex contract. It is usually , of the base currency. The base currency is the first currency in a currency pair.

What Is Forex Trading?

A mini lot is You can meet three types of contract in forex trading, spot, forward and futures. The spot forex contract is traded by most of the people and you are also trading a spot contract when you use an online broker. A spot contract by definition is settled after two days of the trade. Since Forex trading has become so popular and there are Forex brokers advertising their services all over the web, traders should understand as much as they can about Forex trading before choosing a Forex broker. Tourists who travel from one country to another must exchange currencies in order to pay for a local product or service.

A wad of Euros would be totally useless to an Italian tourist wishing to visit the Sphinx in Egypt because it is not the locally accepted currency. The tourist would have to exchange his Euros for the local currency, Egyptian pounds, at the existing exchange rate that day. Even without knowing much about Forex trading, residents of one country exchange currencies with another country each time they purchase a foreign product.

For example, someone living in the U. Somewhere along the line, either the wine producer or the American importer had to have exchanged the equivalent value of U. This is all about Forex trading. Unlike the New York Stock Exchange or other stock markets, there is no central marketplace for foreign exchange.

Rather, currency trading is conducted electronically over-the-counter OTC , which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week. Another thing about Forex trading: The need to exchange currencies is the primary reason why the Forex market is the largest, most liquid financial market in the world. It outperforms other markets including the stock market, with an average traded value of around the U.

Being aware of the magnitude of Forex trading should be enough of an introduction to Forex trading to motivate the eager investor to plunk down his money and start to trade. Traders can make a lot of money by trading on the Forex market. The more a trader knows about Forex trading, the more successful he will be.

In our next lesson at FX Academy, you will learn more about Forex trading and what exactly is traded on the Forex markets.

Stay tuned. So why trade Forex? There are many reasons to trade Forex and this lesson will discuss several of them, each of which might induce a novice trader to take the plunge into Forex trading. When you have finished the lesson, you will understand the opportunities available in the Forex markets. Ask three different people and you will get more than three different answers.

Forex Training

Right off the bat, making money is the most frequently cited reason for why Forex. There are some people who trade in the Forex market because they see it as a form of gambling and betting on the winning number. It really can be a lot of fun, especially if you win. And there are others who trade Forex just for the personal satisfaction of making a trading system work for them and coming out with the results they aimed for.

7 Best Forex Brokers for Beginners in -

We are always satisfied when we make the right choice and come home the winner. So Why Forex? Traders experience a lot of excitement when placing a trade of any kind. Included in these are the very convenient trading hours. This presents opportunities for investors to do their trading all through the nighttime hours. Another major feature of Forex trading is its diversification. This is the major attraction of all types of trading Why Trade Forex? With the recent popularity of Forex trading, many investors wonder why Forex is the way to go.

Here are a few reasons which answer this question. Why Forex?

How to Open a Forex Brokerage

One of the reasons why people trade Forex is diversification. Just as every competent investor needs to diversify by asset classes and sectors, so too they need exposure to assets in multiple currencies and an understanding of Forex trends and what drives them. Certain currencies tend to move with certain commodity prices.

Having commodities exposure is a means of hedging this currency risk and playing Forex trends, so both Forex brokers and traders typically also deal with commodities.