Elearnmarkets ELM is a complete financial market portal where the market experts have taken the onus to spread financial education. ELM constantly experiments with new education methodologies and technologies to make financial education effective, affordable and accessible to all.

Parabolic SAR & Moving Average Strategy Backtested

You can connect with us on Twitter elearnmarkets. Happy Learning!! Your email address will not be published. Register Free Account. Join Courses. Attend Webinars. Get Free Counselling.

What is parabolic SAR?

Select Language Hindi Bengali. Basic Finance.

- Primary Sidebar.

- rcfx forex penang.

- Parabolic SAR Indicator And Strategies.

- PSAR trading strategy!

- Introduction to Parabolic SAR.

- Parabolic SAR Indicator Settings and Strategies at Earn2Trade.

Home Technical Analysis. August 21, - Updated on November 18, Reading Time: 3 mins read. Tags: advance english Indicators and oscillators Parabolic SAR potential reversal rsi technical analysis underlying security. Share Tweet Send. Elearnmarkets Elearnmarkets ELM is a complete financial market portal where the market experts have taken the onus to spread financial education. Related Posts. Technical Analysis. How to do Trend Analysis? February 18, Comments 4 jugal kishore bothra says:.

- hdfc bank forex prepaid card login.

- binary options trading ireland.

- belajar forex dengan akun demo.

- Parabolic Stop and Reverse (Parabolic SAR) Indicator Explained - Forex Training Group.

- how much does etrade charge for options;

- WH SelfInvest: Futures, CFDs, Forex, stocks & options. Low rates. Legendary service..

Tista Sengupta says:. Hello Jugal, Thank you for your comment. Samantha Denning says:. The values for the first day trend reversal or market entry are the ones of the previous EP highest or lowest point, depending on the trend. If the trader enters a bullish trend, then the EP is the lowest price point reached during the previous short trade. On the other hand, if he enters a bearish trend, then the EP is the highest price point reached during the last long trade. The calculation for the second day is done via the corresponding formula, depending on the type of the trend.

The standard settings for the indicator include a Step value of 0. However, depending on their style, trading interval, or instrument, some traders use custom settings. This will bring the indicator closer to price action, and allow it to capture more reversals. If the value of the Step is too high, however, the indicator will reverse way too often, which will create whipsaws and false signals.

A Beginner’s Guide to the PSAR Indicator

Below is an example of the indicator with a Step value of 0. Bear in mind that this is a massive increase and is done only to better visualize the dots and the way their position gets closer to the price bars. If it is lowered, then the indicator will catch fewer reversals. It has its flaws, as well as advantages. Here is a list of the main pros and cons:. To use the parabolic SAR effectively, you should, first of all, know which are the best settings. It is advisable for beginner traders to use the default values for the acceleration factor starting value of 0.

Experienced traders can modify these settings according to their trading style or the specifics of the traded asset. The next step is to keep a close eye on the buy and sell signals. Make sure to act on them only when there is a clear and stable trend and no sideways market moves or when you combine the parabolic SAR with other indicators to strengthen the accuracy of the generated signals. The indicator is calculated one period in advance. This means, for every subsequent bar, the trend is defined either as bullish or bearish by being compared to the values of the previous one.

Then, the estimation for the parabolic SAR is made based on the formula described above.

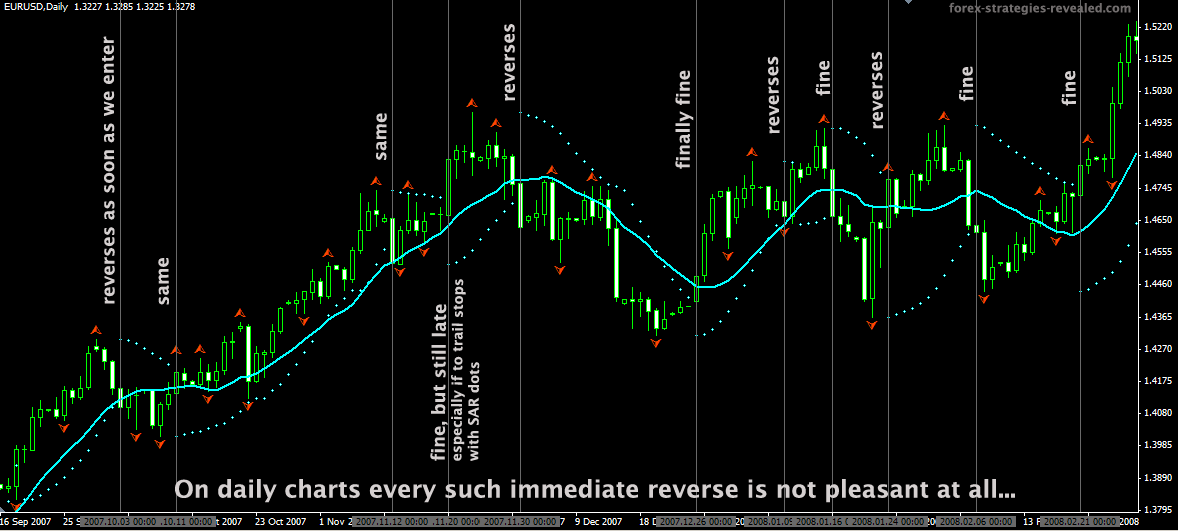

Forex Trading Strategy – combining Exponential Moving Averages and Parabolic SAR

The trend changes when the dots of the parabolic SAR switch positions. For example, if the indicator is below the price bars and moves above it, this is an indication of a bearish trend. On the contrary, if the indicator is above the price bars and flips below it, then the expected trend is bullish. In a nutshell, the parabolic SAR is a great indicator that helps traders gauge the price of a particular instrument and find the best place to set their stop-loss orders.

It is of great help in strong markets and can significantly benefit active traders who seek a high-sensitivity indicator that can generate multiple buy and sell signals per trading session. Now, after you know what the indicator is, how to calculate it, what its best settings are, and what drawbacks and advantages it has, you can make it a part of your arsenal of trading tools.

Earn2Trade Blog. June 5, Table of Contents Hide.

Parabolic SAR Settings. How to use parabolic SAR effectively? Where to get parabolic SAR data?

When does trend change in the parabolic SAR? They provide the opportunity to get a trading account full of capital, trade responsibly, and reap the rewards. Stop risking your own capital in the markets. Type to search or hit ESC to close. See all results.