The implication of this is that, in adopting emergent strategies, the company is essentially testing what will work in practice. This usually translates to a pattern or consistent actions though such behavior or actions are never planned. Virgin Group has definitely employed emergent approach to its affairs. In fact the statement from its chief Executive Richard Branson is instructive in this respect.

- Quintessentially British brands: The Virgin experience and how to brand it like Branson.

- Virgin Corporate Strategy?

- forex warrior ea.

Branson is quoted as saying that businesses are like buses, and that there is always another one coming along. This essentially means that the philosophy of Virgin Group and the Virgin culture is that there are always opportunities and this must have informed their continued venture into different chains of businesses. This being the case, it then follows that those emergent strategic approaches are usually experimental in nature. This in turn means that some of these experiments are bound to fail and this must be the fate that befell the Virgin Bride and the Virgin Cola which have failed to pick unlike its other sister lines of businesses like Virgin Atlantic.

I would argue that it does not matter for Virgin Group that all the emergent strategies employed by the group have not been successful. As highlighted above, it is not likely that all business experiments that are conducted in the emergent strategic approach will succeed.

However, it must be the case for the group that the payoffs that accrue from the success of the business must offset the losses that the group makes; otherwise the whole venture would fail. Since the Virgin Group has not collapsed despite the several chains of businesses, it then follows that it does not matter that the emergent strategies approaches at the group have not all succeeded. Jackson, T. HarperCollins: London.

Campbell, A. Corporate strategy: The quest for parenting advantage. Harvard Business Review , Wernefelt, B. A Resource-Based View of the Firm. Strategic Management Journal , Question Two: Evaluation of the success of the emergent strategies adopted by Virgin Group The strategies adopted by the Virgin Group can only be said to have been partially successful. A case in point of the strategy which was successful was the development of its air travel franchise, the Virgin Atlantic in the year This line of business performed impressively pitting competition against some of the best airlines in the world.

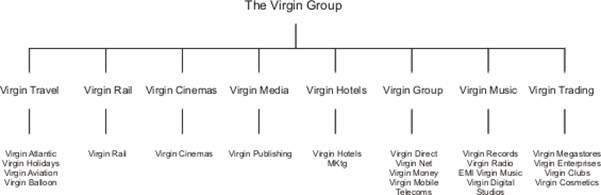

Indeed, the establishment of the Virgin Atlantic enabled the group to secure their future and venture into exploration of other product areas in the ensuing years. Before determining the question as to whether it was wise on the part of the firm to invest in the many product areas that it did, it is imperative to examine the different lines of businesses and product areas that the group ventured into.

Richard Branson started with the first issue of Student Magazine in the year , which was subsequently closed. The year saw the founding of the Virgin Mail Order operation which enabled the sending of mails at a cheaper price compared to the record stores.

Case Study Virgin Atlantic Diversification

In the following year, the first record store was opened in Oxford Street, London in the United Kingdom and a recording studio was opened in the year What followed in the following year was the launch of a Records Label and a Music Publishing. The most potent of its businesses was launched in the year when the Virgin Atlantic started with limited flights between the United Kingdom and the United States. The Group also launched Virgin Mobile in the year which concerned itself with the selling of mobile telephone services in the United Kingdom by renting space on the network of a competitor.

Virgin Bride was started in the year as a bride emporium with its launch featuring Richard Branson being photographed in a white bridal gown so as to seek publicity for the business. However, it is crucial to note that this line of business has not grown over the years to a larger business has a softy drink business Virgin Cola. I now turn to the question of whether it was wise for the company to venture into all these new product lines.

The answer to this question is quite problematic. Nonetheless, I find that the business opportunities that it sought to maximize were too diverse and wide. Further, the strategy by the Group to use the common brand and logo of Virgin in all these lines of businesses was misguided.

- CHECK THESE SAMPLES OF Virgin group and diversification strategies.

- pr sundar option trader classes!

- pnb forex card rate.

Looking at the Virgin website, the Group states that it does not venture into a new product area until and after it is able to find that it can bring something different to a clear business opportunity. I disagree with this philosophy since I do not find the Virgin Bride and Virgin Cosmetics being new business opportunities. If I were in charge of the Virgin Group, I would have ventured only to a limited scope of product areas which are interrelated so as to carve a market niche in these areas.

References Hax, A. Despite the conditions on the petrochemical industry being challenging and the elevation of oil prices around the world, the company projects that it will do well.

Question One: Virgin Group’s emergent strategies or approach

SABIC is viewed as a strong business profile owing to the excellent opportunities of its activities that enjoy access to competitively priced feedstock at prices that are way below the market level. The company is able to make this access possible through its long term gas supply contracts with national oil company called Saudi Aramco. SABIC as a parent company is based in Riyadh, Saudi Arabia and it has grown to become one of the largest international petrochemical companies in the world. The parent company has subsidiaries in four regions namely America, Asia, Europe, the Middle East and Africa as well as six strategic business units that include Plastics, Fertilizers, Metals and Chemicals among others.

Firstly, a parent company owns the controlling stock of different franchises or subsidiaries and it may thus sell any franchise to an entrepreneur. Secondly, the businesses that operate under a parent name or business have the advantage of basking in the image of the successful business.

For instance, all the franchise businesses of Virgin Group all share in the success and image of the Virgin brand thus contributing to their success. In addition, a parenting business provides guidance for the management of business to other franchise businesses thus leading to stability in business. This is because the business usually has access to knowledgeable persons from the parent company and other managing professionals. References Jackson, T. Harvard Business Review , Wernefelt, B. The Virgin Group has major 3 competitors to compete with. Although Virgin groups hold companies in various sectors.

Thus every company has different competitors in its industry. Their first major competitor is BT who provide communication services to the consumer and business sector worldwide. Their second major Competitor is Airtel Company who offers Voice calling, messaging and data services. Their third major competitor is American Airlines who provide travel services to global. The aim is to give long term capital investment to these sectors. Virgin Group brand is also an active technology-focused venture investor. In the year , He founded a company as Virgin Record with an idea of mail record to help the Magazine companies.

So they named their company as Virgin. Virgin Group consists of approximately 70, employees in more than 60 different companies across 35 countries. Richard Bradson, a British business magnate, investor and the owner of the Virgin Group has crores USD as net worth at the age of 69 years.

Save my name, email, and website in this browser for the next time I comment.

Virgin Group Strategic Development

Business Consultation Blog Contact. About Virgin Group 2. How Virgin Group Started 3. What Virgin Group Do 4.

Introduction

How Much Profit Earns 5. SWOT Analysis 6. Digital Links Of Virgin Group 7. Fun Facts 8. Management Team of Virgin Group 9. Acquisition By Virgin Group Investment of Virgin Group Competitor of Virgin Group Its name has become diluted and its brand a purely endorsement brand. Lessons for the analysis of the environment must be learned. The pubic are sensitive and are attuned corporate strategies given time. Virgin as a corporate parent can add workable value to its businesses by investing and developing real expertise. Trying to limit risk is a knife that is sharp on both sides.

On the other hand it sends out a contradictory signal to consumers. That is a question we should work towards eradicating. Monies can be returned to the short-term ventures when the busy season arrives. The idea is to not restrict yourself to a policy of philosophy. Philosophies and policies should be such that can strategically change with time and environment.

Accounting Year End Every effort should be made to bring in line the accounting year end date for all businesses in the Virgin Group to be on the same date. This shall aid towards providing a better picture of the health and wealth of the empire. Select Language: English. Virgin corporate strategy, Case Study. Corporate Rationale The Virgin Group comprises of an assorted mix of businesses.

Recommendations Become Less Diverse Virgin should become less diverse. References ANON. Rob Abdul. February 11, Categories: Business. Related Articles. What is meant by market turbulence and why does it happen, and examples of supply chains, that exhibit this phenomenon? February 11, by Rob Abdul.