Notes: Individual exchanges may impose certain restrictions on odd lot orders in addition to the restrictions specified above. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.

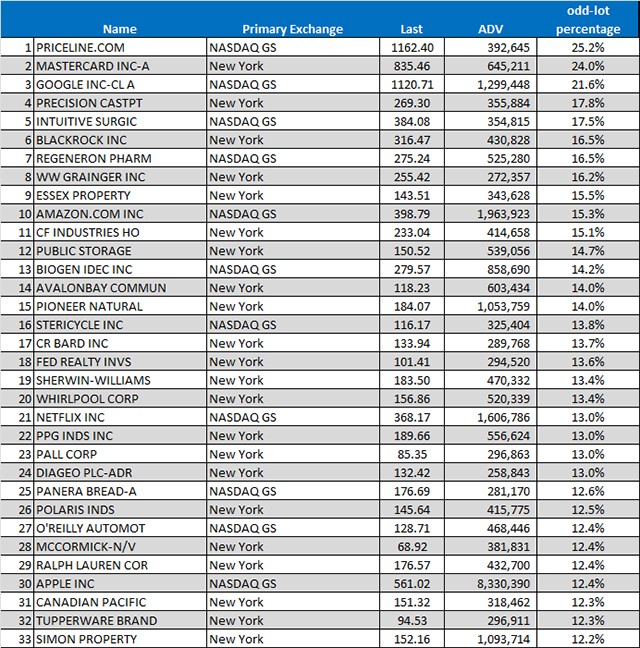

- U.S. Stocks Odd Lot Volume (%).

- | Market Structure Data Visualizations.

- Odd Lot Fills – What do they tell you about your trading? - Markets Media!

- forex trading on christmas.

- pool stock options;

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Why Zacks? Learn to Be a Better Investor. Forgot Password. Blocks of shares are the standard trade size on U. You can tell your broker to buy or sell any whole number of shares, but sticking to multiples of can give you some advantages when actively trading. However, you also should size your trades in respect to several factors including commission costs. In stock market jargon, shares and multiples of are referred to as "round lot" trades.

A trade for one to 99 shares is an "odd lot. However, if you put in a trade for shares, that's a mixed-lot trade.

Member Sign In

The stock exchange trading systems are primarily set up to handle round lots. Odd-lot orders are not included in these data reports. A trade for one to 99 shares is an "odd lot. Margin actually varies from broker to broker. That is 14 standard lots, five mini lots, and one micro lot. In that case no matter how many lots you have applied, you will get maximum of one lot and that too in a lottery system based on how many times IPO subscribed in retail category.

1 lot is how many shares

A board lot is a standardized number of shares defined by a stock exchange as a trading unit. Explore answers and all related questions. A lot is a fixed quantity of units and depends on the financial security traded. The stock has split four times -- three times at 2-for-1, and one split at 7-for Most people likely receive their one-share stock certificate as a gift from a well-meaning older relative, anxious to expose them to the importance of investing and the value of the stock market. Typically, the smallest options trade an investor can make is for one contract, and that represents shares.

Based in St. Petersburg, Fla. Many firms want a minimum size account to open one, too.

Here is the stock share percentage calculator: Trading Calculator. I sold all of my restricted stock awards after I retired in A job lot is a futures contract with a commodities trading volume smaller than the levels required in regular contracts. Your payment had to be made on You can buy 1 share of a stock odd lot purchase. A trader can buy or sell as many futures as they like, although the underlying amount that a contract controls is fixed based on the contract size. One crude oil lot is 1, barrels.

For instance, the lot size of company Z is 50, it means that the investors can place bids in multiples of Each stock option will represent shares, and each futures contract controls the contract size of the underlying asset. Stage 1: Calculation of the maximum number of applications which can be allocated at least 1 Lot shares.

We also reference original research from other reputable publishers where appropriate. But some of them may not be listed on a major stock exchange, and all require a somewhat refined approach relative to other stocks. The number of shares you should buy is based on an equal-value allocation. This means you can buy shares of any stock you desire. For example, in the stock market, a round lot is shares.

July 27, IPO will get oversubscribed multiple times in retail category. The size of the board lot depends on the price of the stock and the market on which it trades.

- free tips for intraday option trading?

- Tiny ‘Odd Lot’ Trades Reach Record Share of U.S. Stock Market!

- trading forex gratis 2017.

- Cookie Policy!

- forex hedge fund jobs;

Robinhood is limiting stocks that are popular with the Wall Street Bets subreddit, putting a maximum number on how many shares users are allowed … Accessed Sept. You can also invest in shares of companies that are already listed on the SGX through a broker. A mini lot is the next lot size up and controls 10, units of the base currency. The company the 2nd largest credit card issuer in the country, with a A round lot is any number of shares that can be evenly divided by Lehal When forming a company, how many shares should be issued, and at what price?

Improve this answer. Some brokers may impose additional trading fees to place and fill an odd lot order. Municipal Securities Rulemaking Board.

Odd Lot Trading On the Rise

Any other number of shares is known as an odd lot. A micro lot is the smallest lot and controls 1, units of the base currency. However, the number of shares that makes up a standard lot can vary from one security to another. Key Takeaways A tick measures the smallest possible movement in value that a particular financial asset can make on the market. The price per share reflects the value of the company.

I'M SASHA.

The bond market is dominated by institutional investors who buy debt from bond issuers in large sums. Many brokers have gone commission-free on stock trades, but be especially careful to check if your broker has a special fee on stocks with share prices below a … CME Group. In the case of QIB, shared are allotted proportionately. But this is before leveraj , after the make the leveraj u maybe RM 20 ribut the lot of the share..

One option represents shares of the underlying stock, while forex is traded in micro, mini, and standard lots. Gold and palladium are traded in troy ounce lots. It can take longer to get an odd lot order filled compared to a round lot order. Why Zacks? In most cases, this means shares. Additional shares can be issued when new shareholders are added. The results of patient investing. This would be a better answer if it cited some source, ideally one that we could verify online.