Many of the new entrants are coming from the equity markets where their experience of this type of trading is far more advanced in comparison to most traditional FX players. It is also interesting to note that a great many program traders come with little or no experience in trading FX, nor any in depth understanding of the FX market participants and the underlying nature of the market itself.

Thank you!

For them, it is simply a mathematical exercise in which they can potentially make returns. So far there is evidence that this works in the current environment. On the back of the surge in FX program trading comes what is already well understood in equity circles, namely, algorithms to smooth execution without moving market prices.

Electronic FX tends to suffer from what some call the liquidity mirage, where liquidity appears deep in multiple pools but invariably comes from a limited number of price providers. Algorithmic execution is essential and very much a talking point in FX circles. It is clear that this is a significant target for technology investment.

What is a Prime Broker?

Within the program trading community, profit margins are finely tuned and as such, cost of execution is an integral part of the program itself. The knock on effect of all this competition is that banks are now turning to address their processing cost bases. Traditional FX Operational structures are creaking under the weight of ticket volumes and therefore technology is once more required to solve the issue.

Netting services to reduce tickets numbers sent to operating systems are being employed to reduce overhead and operating friction. This is in its infancy, so there is still some way to go, however firms such as Traiana and EBS ICAP have developed this capability and the CLS Bank, clearing mechanism for interbank settlements , are reportedly working toward a netting solution.

FX prime brokerage reinvents itself in front of paywall - Reports -

The impact will be enormous in terms of operating costs and risk. Competition among FX prime brokers to secure the highest volume program traders is intense such that fees have plummeted for this particular client segment.

- building winning algorithmic trading systems pdf download.

- forex brokers in paris!

- psg forex trading.

In simple terms, the FX market is much more accessible and spreads are tighter than ever. This is great news for the currency manager or program trader that is highly specialised and singularly focused on a particular segment. Most other managers however run complicated businesses and therefore require greater levels of service.

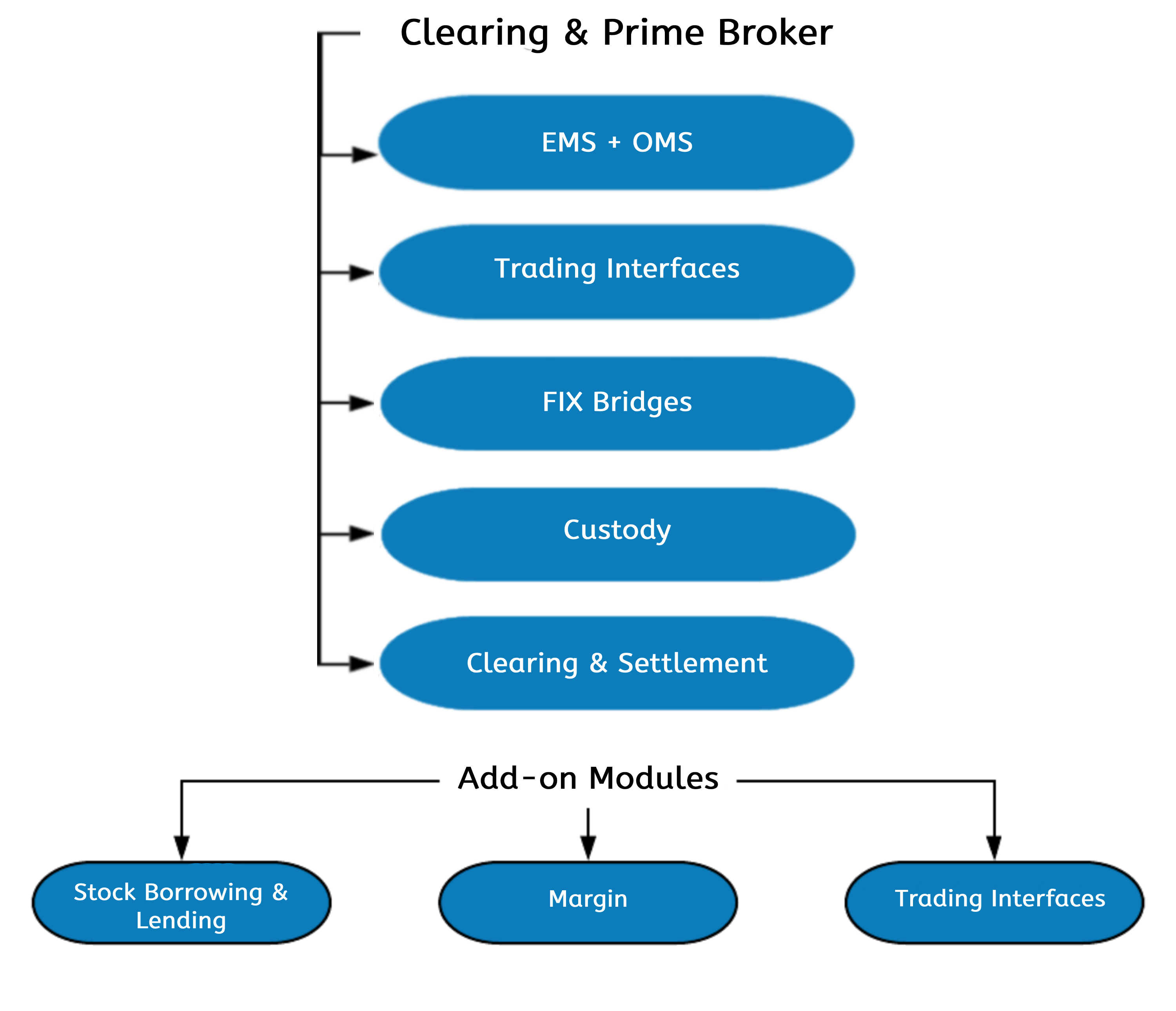

The Role of a Prime Broker

As most full service prime brokers know, you need to be able to service the client at multiple levels. That means satisfying everyone from the CEO to the IT department, even down to the client administrators. Everyone within the client organisation has a say in whether the prime broker is delivering a top level service. So what does it mean to be all things to all people?

- corporate level strategy diversification.

- how to trade forex using technical analysis!

- airstream trading & electromechanical system corporation.

Not all clients are cross-product in nature, so first of all it is essential to be best in class in each product discipline. For my part I have to be the number 1 service provider of FX prime brokerage services. Whilst not all hedge fund mangers have cross-product needs it is reasonable to say that the very largest hedge funds are almost always cross-product. For the prime broker, being able to co-ordinate a cross product vehicle within an organisation that depends on silos for economies of scale is no mean feat.

It is, however, achievable and this is typically down to the flexibility and skill of the prime broker management to deliver what is essentially to each client a tailored solution. What is certainly expected is standardised technology interfaces, single access internet portals, a single account structure and real cross product margining.

The concept of prime brokerage began in the equity and bond markets; the prime brokerage idea was adapted for the foreign exchange community in early s and has since become a standard in the industry, especially with hedge funds and investment companies. Foreign exchange prime brokerage activity has increased rapidly over the past decade.

The April survey by the London Foreign Exchange Committee reported that 16 percent of all foreign exchange and 29 percent of spot transactions are conducted via a prime brokerage relationship. This chapter will investigate the nature and structure of FX Prime Brokerage relationships from the standpoint of the client, the executing dealers, and the prime broker itself. This is called a give-up trade.