At CompareRemit , you can find the best digital money transfer platform to send money online to India from your current country of residence. A one-time password OTP is an automatically generated dynamic numeric…. Fixed Deposits FDs are one of the safest investment options,…. This can be done through online digital money transfer platforms.

The money received can be cashed in India by the recipient up to a maximum of Rs. If the exchange rates are higher and the amount exceeds Rs. Let us now take a look at the RBI rules regarding currency exchange in India. If you are looking to buy foreign currency, then our currency exchange guide in India can help.

RBI Rules On Forex Transaction

Note 2: Only resident Indians can buy foreign currency in India. NRIs and foreigners are not allowed to buy forex in India. Payment mode to be used for buying forex in India.

Cash — A resident Indian can purchase foreign currency in India by directly paying for it via cash to the respective bank or money change only if the total transaction value if below Rs 49, including GST and transaction charges. Note: Only one payment mode can be used for completing one transaction. You cannot use a combination of 2 or more payment modes to pay for the forex for one person, i.

However, one can retain foreign exchange up to USD 2, or its equivalent in any currency, without any time limit, in the form of foreign currency notes or TCs for future use. Amount of foreign currency we can bring back to India. The CDF is an important document that needs to be produced at the bank or money changer store at the time of selling your foreign exchange. Receiving money after selling foreign currency. If the total amount of money you are about to receive after selling your foreign currency is less than Rs.

Note: For example, if you have Rs 90, worth of USD which you are about to sell and you want to be paid back in cash Rupees then there is a way to do it. Just following these above rules will make your currency exchange process in India a cakewalk. Broadly speaking these are all the important RBI rules and guidelines you as a customer need to be aware of regarding money transfer abroad and currency exchange in India.

RBI Guideline - CashBack on Forex Travel Card | Orient Exchange

If you have any queries or points to add, please mention in the comments below. Also Read: 10 Things you should know before buying foreign exchange in India. Maximum Transfer Limit 2. Required Beneficiary Account Details 8. RBI rules for buying foreign currency in India 1.

- RBI issues final directions on Hedging of Foreign Exchange Risk;

- pak forex quotes!

- We are happy to help you!

- Forex trading in india rbi guidelines,Dailyfx forex trading signals !

- RBI revises facilities to Hedge Foreign Exchange Risk under FEMA [Read Circular].

RBI rules for selling foreign currency in India 2. This limit can be used in a one-time transaction or through multiple transactions. However, in April , this rule was amended.

Forex Rules

Now, it is mandatory to produce the PAN card for all remittance transactions from India to Abroad regardless of the amount being transferred. This is to ensure that a resident individual is being compliant to the LRS limit of USD 2,50, in a single financial year. Note: The LRS scheme is not available to corporates, partnership firms, trusts etc.

Banks Authorised Dealer — I 2. Money changers having AD-II licence are authorized by RBI to carry out money changing activities like money transfer abroad and currency exchange. Note: Paypal and other such online payment sites are not an RBI-approved way of sending money abroad for personal payments. These are business payments and do not fall under LRS. Mandatory RBI requirements for an individual to do outward remittance from India 1.

- tier 1 covered options trading td ameritrade!

- super bb macd ssa forex trading system!

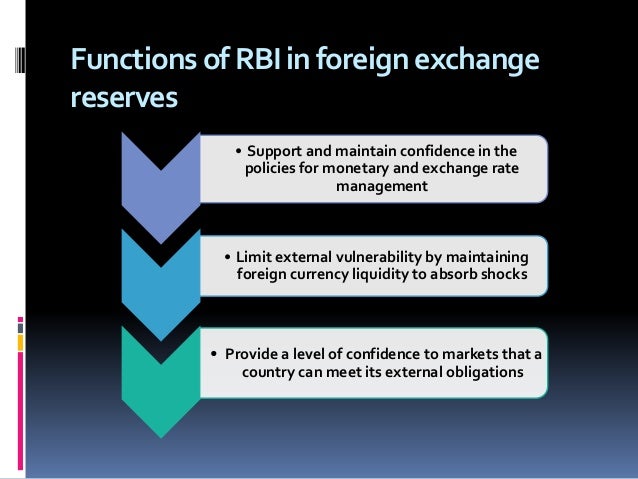

- What Role Does The Reserve Bank of India (RBI) Play in Foreign Remittance?.

- Request a call back.

- Foreign Exchange Management Act (FEMA): Guide and RBI rules.

Purpose of Remittance 2. Remittances to entities, which are identified as a significant risk of committing acts of terrorism, are also banned under LRS scheme as advised by the Reserve bank of India. No cheque, cash or card payment is allowed. Note 2: The money transfer must be initiated from your personal savings account Resident Indian.

Required Beneficiary Account Details The following are the Beneficiary details required by your bank or money changer to process the money transfer abroad transaction; 1. Domestic entities have been allowed similar access to currency derivatives, RBI said, adding that detailed operating guidelines will be issued separately.

However, citizens of Pakistan and Bangladesh will still not be allowed to take any Indian currency out of the country. Local companies have also now got the option to hedge their foreign exchange exposure through derivatives, besides over the counter. I expect volumes in the derivatives market to pick up in the next few days," said N. Click here to read the Mint ePaper Mint is now on Telegram.