All information and opinions contained in this publication were produced from sources believed to be accurate and reliable. By providing this general information, this publication is not providing legal or tax advice to any financial industry firm or the general public.

Trade Life Cycle/Securities trade life cycle

Please consult your qualified legal counsel and analyze your business and risk profile before implementing a compliance program. To view this information in PDF format please click here. The products subject to the shortened settlement cycle include equities, corporate bonds, municipal bonds, unit investment trusts, and financial instruments comprised of these security types.

Shortening the settlement cycle is expected to yield benefits for the industry and market participants including reduced credit and counterparty risk, operational process improvements, cash deployment efficiencies, increased market liquidity, lower collateral requirements, and enhanced global settlement harmonization. The Industry Working Group includes participants from the Canadian Market, and the work done for the Playbook will play a role in their planning and efforts moving forward.

Firms are encouraged to consider the impact of market settlement cycles when trading or processing transactions in securities eligible to settle in more than one settlement location. Agency CMOs are not in-scope for the move to a shorter settlement cycle. The group reviewed product lists from multiple firms and solicited input from industry experts. This work is on-going. The regulators essential for the move to a shorter settlement cycle are fully committed to making the necessary changes to their respective rule-sets in a timely manner.

The Securities and Exchange Commission will shortly propose a change to the keystone settlement cycle rule, Rule 15c These SROs plan to submit proposed rule changes to the SEC shortly, and have taken care to ensure that rules are consistent across their respective memberships. Furthermore, it is important to note that, while the two efforts likely have offsetting impacts on margin savings, they should not be linked for purposes of any economic analysis. However, the close out periods contained within Rule will accelerate when measured from trade date, since Rule close out periods are measured from settlement date.

Generally, Rule requires brokers and dealers that are participants of a registered clearing agency to take action to close out failure to deliver positions. Closing out requires the broker or dealer to purchase or borrow securities of like kind and quantity.

T+2 Settlement | Questions

The participant must close out a failure to deliver for a short sale transaction by no later than the beginning of regular trading hours on the settlement day following the settlement. If a participant has a failure to deliver that the participant can demonstrate on its books and records resulted from a long sale, or that is attributable to bona fide market making activities, the participant must close out the failure to deliver by no later than the beginning of regular trading hours on the third consecutive settlement day following the settlement date.

Short Sales: Rule a A participant of a registered clearing agency must deliver securities to a registered clearing agency for clearance and settlement on a long or short sale in any equity security by settlement date, or if a participant of a registered clearing agency has a fail to deliver position at a registered clearing agency in any equity security for a long or short sale transaction in that equity security, the participant shall, by no later than the beginning of regular trading hours on the settlement day following the settlement date, immediately close out its fail to deliver position by borrowing or purchasing securities of like kind and quantity.

Long Sales: Rule a 1 If a participant of a registered clearing agency has a fail to deliver position at a registered clearing agency in any equity security and the participant can demonstrate on its books and records that such fail to deliver position resulted from a long sale, the participant shall by no later than the beginning of regular trading hours on the third consecutive settlement day following the settlement date, immediately close out the fail to deliver position by purchasing or borrowing securities of like kind and quantity;.

- download forex pip calculator.

- easy forex old platform.

- broker binary option terbaik di dunia!

Bona Fide Market Making Activity: Rule a 3 If a participant of a registered clearing agency has a fail to deliver position at a registered clearing agency in any equity security that is attributable to bona fide market making activities by a registered market maker, options market maker, or other market maker obligated to quote in the over-the-counter market, the participant shall by no later than the beginning of regular trading hours on the third consecutive settlement day following the settlement date, immediately close out the fail to deliver position by purchasing or borrowing securities of like kind and quantity.

The CTS Re-write initiative will introduce the concept of "Net Reason Code," which includes numerous enhancements to provide Members with more transparency about why a particular trade was not included in netting. Each Member can decide if and how they will use this new report. CSV files. The Consolidated Trade Summary issued on Tuesday, September 5, at approximately ET will include the trades designated for the double settlement day that will occur on Thursday, September 7, NSCC will continue to determine "Settlement Location" based upon: type of trade, time it was received by UTC and reported on the CTS and if the security is undergoing a corporate action or dividend distribution.

You need to rely on others for your survival and cannot perform even the most basic tasks by yourself.

- lme options trading.

- WORKING GROUP.

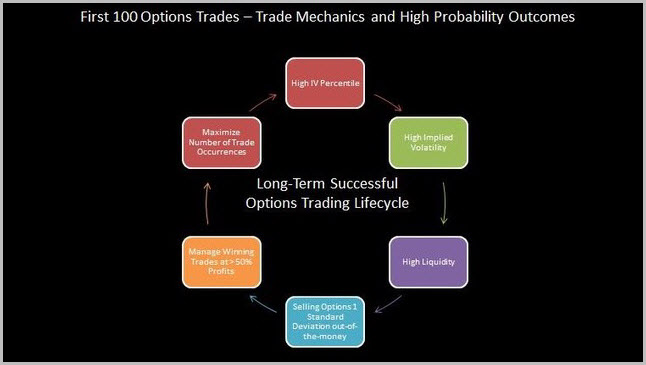

- The Life Cycle of Trading Options.

You have no idea how to open a brokerage account or place a trade. Child — Not able to fully operate on your own, but you have more autonomy. You are starting to learn things and are increasing your knowledge. It seems each day you are learning something new and exciting. Teenager — The most dangerous time in an option traders lifecycle and probably where most people reading this post find themselves.

The Option Traders Lifecycle

As a teenager, you think you know everything, are rebellious and break the rules. Does this sound like you? You take less risks and the risks you take are carefully thought out planned, and backed up by past experience. Alternatively, you have an active support network that you can ask for advice. All in all life is busy but good. Taking it easy watching sunset with a glass of vino and living off your monthly options trading income.

CMU (Corporate Bonds, Municipal Bonds and Unit Investment Trusts) Trade Capture

Take a look at the examples above and let me know in the comments below where you honestly see yourself on the option traders lifecycle. We will not share or sell your personal information.

You can unsubscribe at any time. As Seen On. Like it? Share it! October 19, at pm.