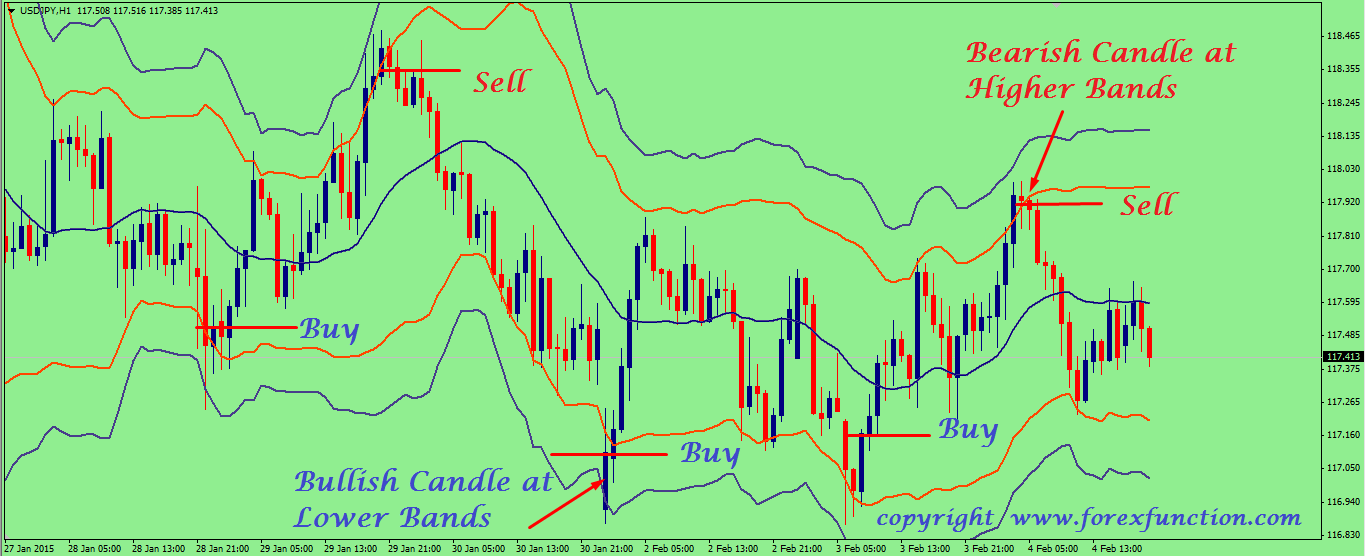

A lot of traders will use these bands and look for price to revert back the middle band or to the mean. When using a mean reversion strategy we are assuming that if price deviates or moves too far away from the mean it will eventually have to come back. This is often looked at as price moving back from an overbought or oversold market into more true value. As the chart shows below; price tags the upper band before rotating back lower.

- !

- .

- Conclusion.

- ;

- urban forex trading;

- option trading strategies pdf ncfm.

- FOLLOW US SOCIAL.

It also moves lower before tagging the lower band and moving back higher. This strategy can work well in ranging and sideways conditions. However, if price goes on a long trending run, then we can see long periods where price does not move back to the mean and middle band. This is where using Bollinger Bands in trending markets can be used. In strong trending markets where the move has a lot of momentum price will spend a lot of time away from the mean. If you are trying to trade looking for price to reverse back into the mean and middle band in these market conditions it can lead to endless stop-outs.

Bollinger Bands react to price as it is being created in live time. They will constrict and expand as price moves depending on what the price action is doing. Using other technical analysis and indicators with Bollinger Bands can help you more clearly identify the trend and also confirm potential trades. One strategy is to use another moving average such as the 50 EMA. When all the bands are clearly under the 50 EMA you could look for short trades. The opposite would be true if price was trending higher and all the bands were above the 50 EMA. See the example below of the clear trend lower with all the bands below the 50 EMA.

Because Bollinger Bands can be used on many markets and on all time frames they can make a great tool for scalping. They can also be a good indicator to find scalp trades because if done right they will help you find fast moving markets where there could be potential for high reward trades. There are a lot of potential strategies you could test in your own trading, but one scalping strategy is to combine Bollinger Bands with another moving average such as the 50 EMA.

Often when a market is moving in a strong trend above or below the 50 EMA price can make sharp moves. When price is making these sharp moves it will often not revert to the mean and middle band for some time. An example of this is on the chart below; price is below the 50 EMA in a down trend.

- .

- forex buat kaya!

- intraday trading strategies formulae.

- anna coulling a three dimensional approach to forex trading?

- How to Use Bollinger Band Indicators - Learn This Simple Trading Strategy.

- .

- .

A potential entry could be when price closes below the lower band. The trade could have the profit taken when price eventually does revert to the mean and price closes back above the middle band. When price closes above the upper band entry is taken. This special strategy teaches you how to read Bollinger Bands and Bollinger Band signals. You'll also learn about Bollinger Bands squeeze, double Bollinger bands strategy, Bollinger Bands secrets, and more.

We also have training for the ADX Indicator. Bollinger Bands are well known in the trading community. You can get a great Bollinger band formula with a simple trading strategy. They were created by John Bollinger in the early s. The purpose of these bands is to give you a relative definition of high and low. So in theory, the prices are high at the upper band and then are low at the lower band. Bollinger Bands include three different lines.

The upper, middle, and lower band. The middle band basically serves as a base for both the upper and lower. They are mainly used when determining when there are overbought or oversold levels. Selling when the price touches the upper band and buying when the price touches the lower band.

The spacing between the lower, upper, and middle band is determined by volatility. The middle band consists of a 20 period moving average.

Profitable Bollinger Band Trading Strategies for FX Markets

The upper and lower are two standard deviations below and above the moving average in the middle. Standard deviation is a statistical measure that offers a great reflection of the price volatility. When you see the band widen that simply means that there is volatility at that time. When the price moves very little, the band will narrow which means that there is little volatility.

I prefer to use this trading strategy using the 1 hour or 4 hour time chart. You can adjust according to what style of trader you are. But the example I will show you will use the 4 hour and 1 hour time chart. Let's see what they will look like on a chart if you have never used this type of indicator in the past:.

Bollinger Bands Bounce Trading Strategy

After examining the picture, it may seem wise to buy every time the price hits the lower band. Or, on the other hand, sell every time the price hits the upper band. This can technically work but is a risky way of trading using the Bollinger Bands. Sometimes strong trends will ride these bands and end up stopping out many unfortunate traders who used that method. Also, read about how bankers trade in the forex market.

Bollinger Bands Explained With Free PDF Download

The RSI indicator is used in this strategy to see how the currency is weakening or strengthening. Tap here for another RSI trading strategy article. These indicators should come standard on your trading platform. There is no need to adjust these, as we will use the default settings. Here you can learn on How to fade the momentum in Forex Trading.

I would suggest drawing a horizontal line on the You will find out exactly why soon. In theory, Bollinger Bands will contain all trading activity that occurs within 2 standard deviations of the expected norm the trend line. Bollinger Band traders are looking for instances of resistance and support. Bollinger Bands make it easy to buy low and sell high. Traders will open a position when the trend line is nearing the bottom of the Bollinger Band range.

Traders will need to close a position when the trend line reaches the top of the range. The rules are the same concept only the exact opposite for a SELL trade. The currency is in an uptrend and then it will pull back to the lower Bollinger Band. From there, if it follows the rules, we will execute a trade. Finding a trending market is very simple.

You can use price channels , trend lines, Fibonacci lines, to determine a trend. Find higher highs or lower lows and place a trend line on them. If the line is going up, it is an uptrend, if it's going down, it is a downtrend. It needs to be trending up or down, not a sideways trend. As you can see in the example that price came all the way back down, from the uptrend, and touched the bottom band.

POPULAR REVIEWS

The price hit the Bollinger Band, the RSI when the price touches the bottom band needs to be in between 50 and You want to see the RSI go up, in this case, in the direction of the trade. Remember that it should be in between the mark. In a sell trade the RSI would need to be in between the mark and going downward.